Rising Cyber Threats

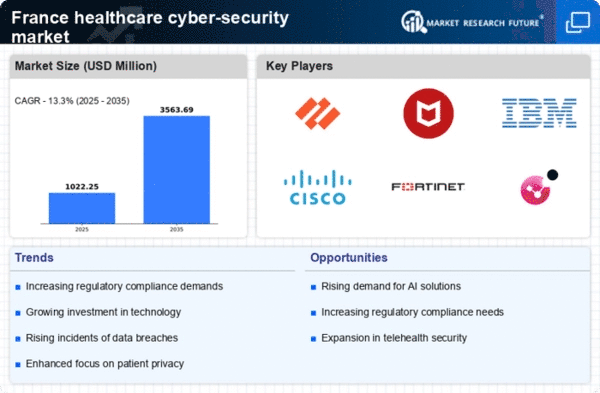

The healthcare cyber-security market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats targeting healthcare organizations. In France, the number of reported cyber incidents in the healthcare sector has surged, with a notable rise in ransomware attacks. This trend compels healthcare providers to invest in robust cyber-security measures to protect sensitive patient data and maintain operational integrity. The French government has recognized this challenge, implementing initiatives to bolster cyber defenses across the healthcare sector. As a result, the market is projected to grow at a CAGR of approximately 12% over the next five years, reflecting the urgent need for enhanced security solutions.

Integration of IoT Devices

The proliferation of Internet of Things (IoT) devices in healthcare is a significant driver for the healthcare cyber-security market. In France, the adoption of connected medical devices has increased, enhancing patient care but also introducing new vulnerabilities. These devices often lack robust security features, making them attractive targets for cybercriminals. Consequently, healthcare organizations are compelled to implement comprehensive cyber-security strategies to protect these devices and the data they generate. The market for IoT security solutions is expected to expand rapidly, with estimates suggesting a growth of 15% annually as healthcare providers seek to mitigate risks associated with connected technologies.

Government Initiatives and Funding

The healthcare cyber-security market is significantly influenced by government initiatives aimed at improving cyber resilience within the healthcare sector. In France, the government has allocated substantial funding to support healthcare organizations in adopting advanced cyber-security technologies. This funding is part of a broader strategy to safeguard critical infrastructure and sensitive health information. The French Ministry of Health has launched programs that encourage collaboration between public and private sectors to enhance cyber defenses. Such initiatives not only provide financial support but also promote best practices in cyber-security, thereby driving market growth. The anticipated investment in cyber-security solutions is expected to reach €500 million by 2026.

Increased Patient Data Privacy Concerns

Growing concerns regarding patient data privacy are driving the healthcare cyber-security market. In France, patients are increasingly aware of their rights concerning personal health information, leading to heightened expectations for data protection. This shift in consumer awareness has prompted healthcare organizations to prioritize cyber-security measures to comply with stringent data protection regulations, such as the General Data Protection Regulation (GDPR). As a result, healthcare providers are investing in advanced security technologies to ensure compliance and build trust with patients. The market is likely to see a surge in demand for solutions that enhance data privacy, with projections indicating a growth rate of 10% annually in the coming years.

Demand for Comprehensive Cyber Security Solutions

There is a growing demand for comprehensive cyber security solutions that address the unique challenges faced by healthcare organizations. In France, the complexity of healthcare IT environments necessitates integrated security approaches that encompass threat detection, incident response, and compliance management. As cyber threats evolve, healthcare providers are increasingly seeking solutions that offer real-time monitoring and advanced analytics capabilities. This trend is likely to drive market growth, with forecasts indicating that the market for integrated cyber security solutions could reach €1 billion by 2027. The emphasis on holistic security strategies reflects the critical need for healthcare organizations to safeguard their operations and patient data.