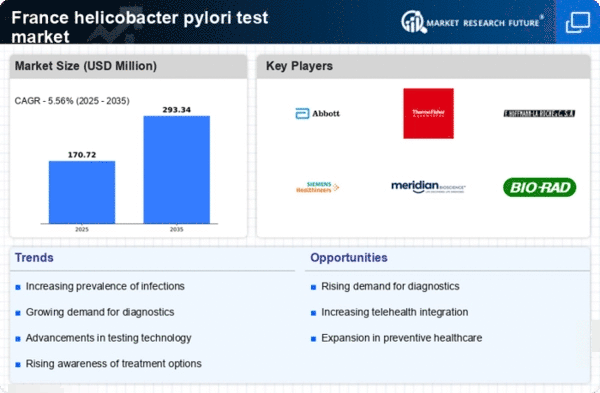

Growing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare in France is a significant driver for the helicobacter pylori-test market. With a shift towards proactive health management, both healthcare providers and patients are prioritizing early detection of diseases. This trend is particularly relevant for conditions associated with Helicobacter pylori, as early diagnosis can prevent severe complications. The French government has been promoting health awareness campaigns that encourage regular screenings, which aligns with the objectives of the helicobacter pylori-test market. Moreover, the rising healthcare expenditure in France, which reached approximately €200 billion in recent years, supports the development and accessibility of diagnostic tests. As preventive healthcare continues to gain traction, the demand for helicobacter pylori testing is likely to increase, reflecting a broader commitment to improving public health outcomes.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic testing are significantly influencing the helicobacter pylori-test market. The introduction of non-invasive testing methods, such as breath tests and stool antigen tests, has made it easier for patients to undergo screening. These advancements not only enhance patient comfort but also improve the accuracy and speed of diagnosis. For instance, the breath test has shown a sensitivity of over 90%, making it a preferred choice among healthcare providers. Additionally, the integration of digital health technologies, such as telemedicine, allows for remote consultations and follow-ups, further driving the demand for testing. As these technologies continue to evolve, they are expected to play a pivotal role in shaping the future of the helicobacter pylori-test market, making testing more accessible and efficient for the French population.

Rising Healthcare Expenditure and Investment

The upward trend in healthcare expenditure in France is a key driver for the helicobacter pylori-test market. With healthcare spending projected to increase by approximately 3% annually, there is a growing allocation of resources towards diagnostic testing and treatment options. This investment is crucial for enhancing healthcare infrastructure and ensuring that patients have access to necessary testing services. Furthermore, the French government has been actively investing in research and development initiatives aimed at improving diagnostic technologies, which directly impacts the helicobacter pylori-test market. As funding for healthcare continues to rise, it is anticipated that more healthcare facilities will adopt advanced testing methods, thereby increasing the overall demand for helicobacter pylori testing. This trend reflects a broader commitment to improving health outcomes and addressing the needs of the population.

Regulatory Support for Diagnostic Innovations

The supportive regulatory environment in France plays a vital role in fostering growth within the helicobacter pylori-test market. Regulatory bodies are increasingly facilitating the approval process for new diagnostic tests, which encourages innovation and competition among manufacturers. This environment not only accelerates the introduction of advanced testing solutions but also ensures that they meet stringent safety and efficacy standards. For instance, the French National Agency for the Safety of Medicines and Health Products (ANSM) has streamlined procedures for the evaluation of diagnostic devices, which can lead to quicker market access. As a result, the helicobacter pylori-test market is likely to benefit from a continuous influx of innovative testing options, enhancing the overall quality of care provided to patients. This regulatory support is essential for maintaining the momentum of growth in the market.

Increasing Incidence of Helicobacter Pylori Infections

The rising incidence of Helicobacter pylori infections in France is a crucial driver for the helicobacter pylori-test market. Studies indicate that approximately 30% of the French population may be infected with this bacterium, which is linked to various gastrointestinal disorders, including peptic ulcers and gastric cancer. This growing prevalence necessitates effective diagnostic testing, thereby propelling market demand. As healthcare providers increasingly recognize the importance of early detection and treatment, the market for testing solutions is expected to expand. Furthermore, the French healthcare system's focus on preventive care aligns with the need for widespread screening, particularly in high-risk populations. Consequently, the increasing incidence of infections is likely to stimulate growth in the helicobacter pylori-test market, as more individuals seek testing and treatment options.