Emergence of 5G Technology

The rollout of 5G technology in France is poised to revolutionize the IoT Operating Systems market. With its promise of ultra-fast connectivity and low latency, 5G enables a new wave of IoT applications that require robust operating systems capable of handling increased data traffic. The enhanced capabilities of 5G are expected to facilitate the deployment of more complex IoT solutions across various sectors, including smart cities and autonomous vehicles. As organizations begin to leverage the advantages of 5G, the demand for operating systems that can optimize performance and reliability will likely surge. This technological advancement suggests a transformative impact on the iot operating-systems market in the coming years.

Rising Cybersecurity Concerns

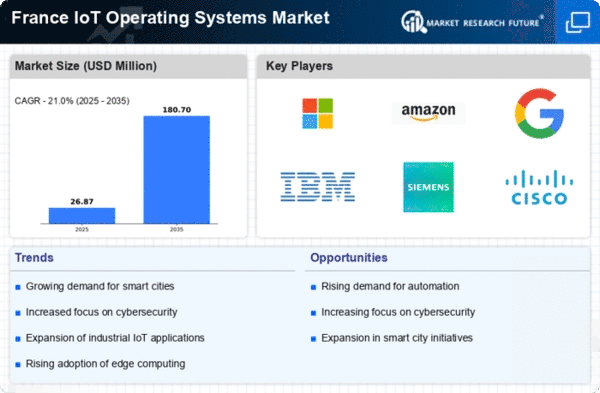

As the number of connected devices increases, so do the cybersecurity threats associated with them. In France, the rise in cyberattacks targeting IoT devices has heightened awareness regarding the importance of security in the iot operating-systems market. Organizations are now prioritizing the implementation of secure operating systems that can protect sensitive data and ensure device integrity. This shift is prompting developers to focus on incorporating advanced security features into their operating systems. The growing concern over cybersecurity is likely to drive innovation and investment in the iot operating-systems market, as businesses seek to mitigate risks and safeguard their IoT infrastructure.

Growing Focus on Data Analytics

The increasing emphasis on data analytics within the IoT ecosystem is a key driver for the iot operating-systems market. In France, businesses are recognizing the value of data-driven decision-making, leading to a surge in demand for operating systems that can support advanced analytics capabilities. The ability to process and analyze vast amounts of data in real-time is becoming essential for organizations seeking to enhance operational efficiency and customer experience. Consequently, operating systems that offer integrated analytics tools are likely to gain traction. This trend indicates that the iot operating-systems market will evolve to accommodate the growing need for sophisticated data processing and analytics functionalities.

Government Initiatives and Support

French government initiatives aimed at promoting digital transformation are significantly impacting the iot operating-systems market. The government has allocated substantial funding to support IoT research and development, with an investment of approximately €1 billion in digital innovation projects. These initiatives encourage businesses to adopt IoT solutions, thereby increasing the demand for effective operating systems. Additionally, regulatory frameworks are being established to ensure data security and privacy, which further drives the need for robust operating systems. As the government continues to foster an environment conducive to IoT growth, the iot operating-systems market is expected to benefit from increased investment and innovation.

Increased Adoption of Smart Devices

The proliferation of smart devices in various sectors, including healthcare, agriculture, and manufacturing, is driving the iot operating-systems market. In France, the number of connected devices is projected to reach 1 billion by 2025, indicating a robust growth trajectory. This surge in smart devices necessitates advanced operating systems that can efficiently manage and process data. As organizations increasingly rely on IoT solutions for operational efficiency, the demand for specialized operating systems is likely to rise. Furthermore, the integration of smart devices with existing infrastructure requires operating systems that can seamlessly facilitate communication and data exchange. This trend suggests that the iot operating-systems market will continue to expand as more industries recognize the benefits of IoT technology.