Growth of Smart City Initiatives

The emergence of smart city initiatives in France is significantly impacting the location analytics market. Cities are increasingly adopting smart technologies to enhance urban living, improve resource management, and promote sustainability. Location analytics plays a pivotal role in these initiatives by providing insights into traffic patterns, energy consumption, and public safety. For instance, the French government has allocated substantial funding for smart city projects, with investments expected to reach €1 billion by 2027. This investment is likely to drive demand for location analytics solutions that can support data-driven decision-making in urban environments. As cities evolve into smart ecosystems, the location analytics market is positioned to thrive, offering innovative tools that facilitate efficient urban planning and management.

Rising Demand for Geospatial Data

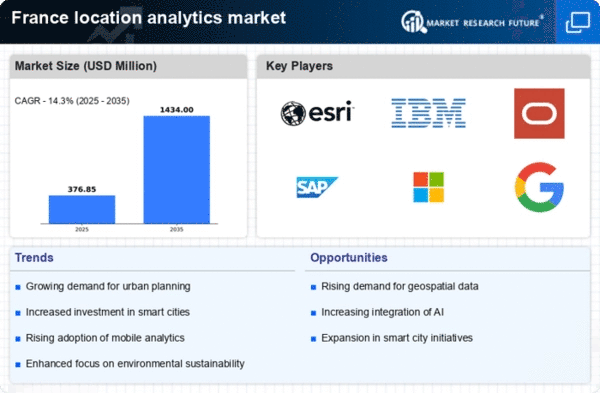

The location analytics market in France is experiencing a notable surge in demand for geospatial data. This demand is driven by various sectors, including retail, transportation, and urban planning, which increasingly rely on location-based insights to enhance decision-making processes. According to recent studies, the market for geospatial data is projected to grow at a CAGR of approximately 15% over the next five years. Businesses are leveraging this data to optimize operations, improve customer experiences, and gain competitive advantages. The integration of advanced mapping technologies and data visualization tools further supports this trend, enabling organizations to analyze spatial relationships effectively. As a result, the location analytics market is poised for substantial growth, with companies investing in innovative solutions to harness the power of geospatial data.

Government Initiatives and Regulations

Government initiatives in France are playing a crucial role in shaping the location analytics market. The French government has been actively promoting the use of location-based technologies to enhance public services and improve urban infrastructure. Initiatives such as the National Geographic Information Infrastructure (IGN) aim to provide accessible geospatial data for various applications, including environmental monitoring and urban planning. Furthermore, regulations surrounding data privacy and security are influencing how organizations utilize location analytics. Compliance with these regulations is essential for businesses operating in this space, as it ensures the responsible use of location data. Consequently, the location analytics market is likely to benefit from increased government support and regulatory frameworks that encourage innovation while safeguarding citizens' privacy.

Increased Focus on Customer Experience

In the competitive landscape of retail and service industries in France, businesses are increasingly prioritizing customer experience, which is driving growth in the location analytics market. Companies are utilizing location-based insights to understand consumer behavior, preferences, and foot traffic patterns. By analyzing this data, organizations can tailor their marketing strategies, optimize store locations, and enhance customer engagement. Reports indicate that businesses leveraging location analytics have seen an increase in customer satisfaction rates by up to 20%. This focus on customer-centric approaches is likely to propel the demand for location analytics solutions, as companies seek to gain deeper insights into their target audiences and improve overall service delivery.

Advancements in Technology and Data Integration

Technological advancements are significantly influencing the location analytics market in France. The integration of advanced technologies such as machine learning, big data analytics, and IoT is enabling organizations to derive actionable insights from vast amounts of location data. These advancements facilitate real-time data processing and enhance the accuracy of location-based analyses. As businesses increasingly adopt these technologies, the location analytics market is expected to expand, with a projected growth rate of around 12% annually. Moreover, the ability to integrate location analytics with other business intelligence tools is likely to enhance decision-making processes across various sectors, including logistics, marketing, and urban planning. This trend indicates a promising future for the location analytics market as organizations seek to leverage technology for improved operational efficiency.