Supportive Regulatory Framework

A supportive regulatory framework is essential for the growth of the medical bionic-implant-artificial-organs market. In France, regulatory bodies have established guidelines that facilitate the approval and commercialization of innovative medical devices. The European Medicines Agency (EMA) has streamlined processes for assessing the safety and efficacy of bionic implants and artificial organs, which encourages manufacturers to invest in research and development. This regulatory support not only enhances market entry for new products but also instills confidence among consumers regarding the safety of these technologies. As regulations continue to evolve, they are likely to create a conducive environment for innovation, thereby driving the medical bionic-implant-artificial-organs market forward.

Rising Incidence of Chronic Diseases

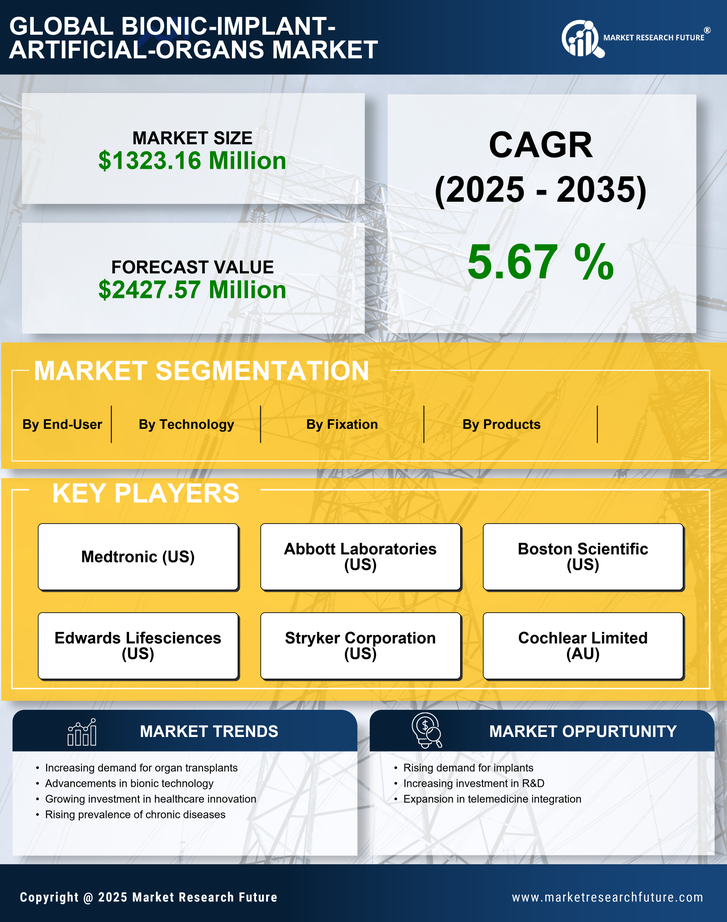

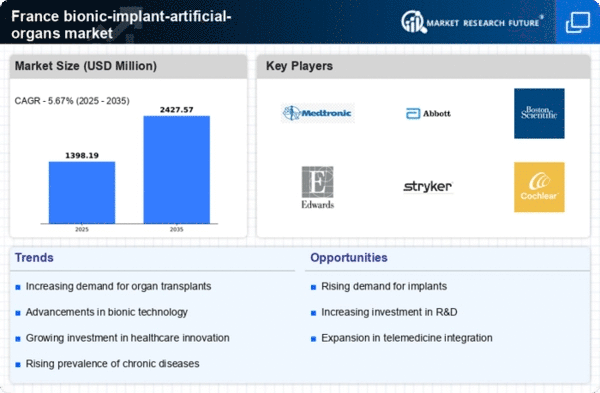

The increasing prevalence of chronic diseases in France is a pivotal driver for the medical bionic-implant-artificial-organs market. Conditions such as diabetes, heart disease, and renal failure necessitate advanced medical interventions. According to recent health statistics, approximately 30% of the French population suffers from at least one chronic condition, leading to a heightened demand for innovative solutions. Bionic implants and artificial organs offer potential alternatives to traditional treatments, thereby enhancing patient outcomes. The healthcare system's focus on improving quality of life for these patients further propels the market forward. As the population ages, the incidence of chronic diseases is expected to rise, suggesting a sustained growth trajectory for the medical bionic-implant-artificial-organs market in the coming years.

Increased Investment in Healthcare Innovation

Investment in healthcare innovation is a significant catalyst for the medical bionic-implant-artificial-organs market. France has been actively promoting research and development in the medical technology sector, with government initiatives aimed at fostering innovation. In 2025, the French government allocated approximately €1 billion to support medical technology advancements, which includes funding for bionic and artificial organ research. This financial backing encourages collaboration between public and private sectors, leading to the development of cutting-edge solutions. The influx of capital not only accelerates product development but also enhances the competitive landscape, thereby driving the medical bionic-implant-artificial-organs market forward. As more innovative products enter the market, patient access to advanced medical solutions is likely to improve.

Technological Integration in Healthcare Systems

The integration of advanced technologies into healthcare systems is a driving force for the medical bionic-implant-artificial-organs market. The adoption of digital health solutions, such as telemedicine and electronic health records, facilitates better patient management and monitoring. In France, approximately 60% of hospitals have begun implementing digital health technologies, which enhances the efficiency of healthcare delivery. This integration allows for seamless communication between patients and healthcare providers, ensuring timely interventions when using bionic implants or artificial organs. As healthcare systems continue to evolve, the demand for innovative medical solutions is likely to increase, thereby propelling the medical bionic-implant-artificial-organs market. The synergy between technology and healthcare is expected to yield significant advancements in patient care.

Growing Awareness and Acceptance of Advanced Medical Solutions

The growing awareness and acceptance of advanced medical solutions among patients and healthcare providers is influencing the medical bionic-implant-artificial-organs market. Educational campaigns and outreach programs have increased understanding of the benefits associated with bionic implants and artificial organs. Surveys indicate that over 70% of healthcare professionals in France are now more open to recommending these technologies to patients. This shift in perception is crucial, as it encourages patients to consider bionic solutions as viable options for treatment. Furthermore, as success stories of patients benefiting from these technologies become more prevalent, the market is likely to experience accelerated growth. The increasing acceptance of these advanced solutions is expected to play a vital role in shaping the future of the medical bionic-implant-artificial-organs market.