Growth of Cloud-Based Solutions

The market is witnessing a notable shift towards cloud-based solutions, which offer flexibility and scalability for healthcare providers in France. Cloud technology enables the storage and sharing of large imaging files, facilitating collaboration among medical professionals. This trend is particularly relevant as healthcare institutions seek to reduce costs and improve accessibility to imaging data. The market for cloud-based medical imaging software is projected to grow by 20% annually, driven by the increasing need for remote access to imaging data and the ability to integrate with other healthcare systems. As a result, the medical imaging-software market is likely to expand, reflecting the growing preference for cloud solutions in the healthcare sector.

Focus on Patient-Centric Healthcare

The market is evolving in response to the growing emphasis on patient-centric healthcare in France. Healthcare providers are increasingly adopting software solutions that enhance patient engagement and streamline the imaging process. This shift is characterized by the integration of features such as online appointment scheduling, real-time access to imaging results, and improved communication between patients and healthcare professionals. As a result, the medical imaging-software market is expected to witness a growth rate of approximately 12% over the next few years. This trend indicates a broader movement towards personalized healthcare, where software plays a crucial role in enhancing patient experiences and outcomes.

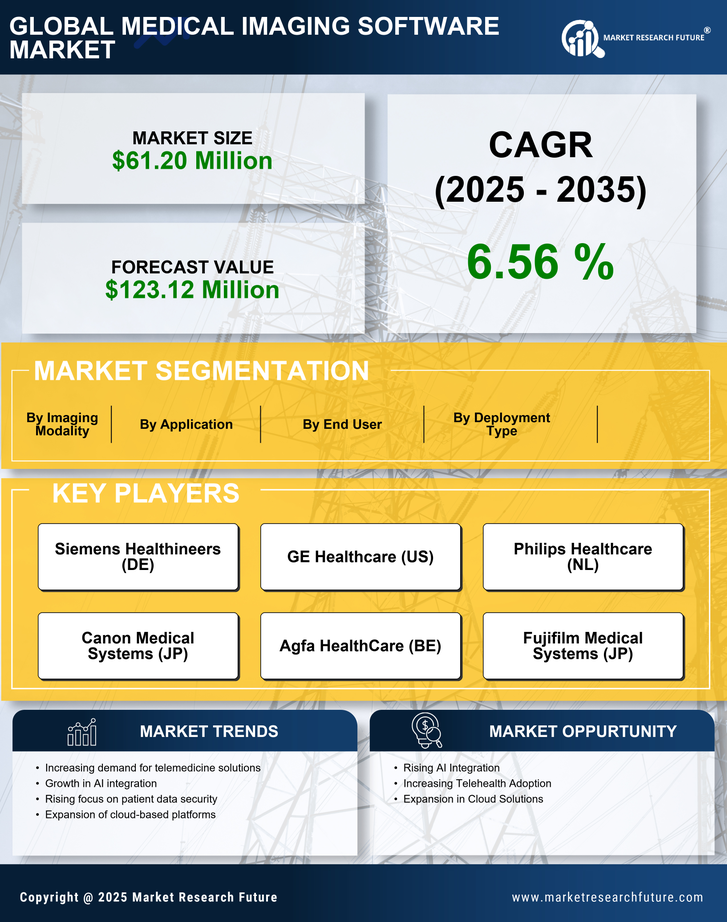

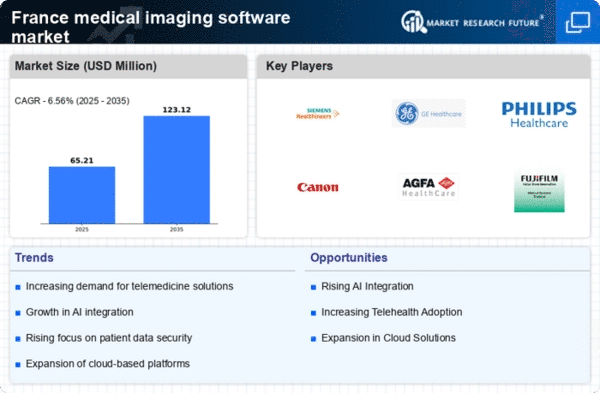

Increasing Demand for Diagnostic Imaging

The medical imaging-software market is significantly influenced by the increasing demand for diagnostic imaging services in France. With a growing aging population and a rise in chronic diseases, the need for effective diagnostic tools is paramount. Reports indicate that the diagnostic imaging market in France is expected to reach €2 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. This demand is driving healthcare providers to seek advanced imaging software that can enhance the quality of care. Consequently, the medical imaging-software market is likely to expand as healthcare institutions prioritize investments in software that supports high-quality imaging and efficient data management.

Regulatory Compliance and Quality Standards

The medical imaging-software market is significantly impacted by the stringent regulatory compliance and quality standards set forth by health authorities in France. The need for software solutions that adhere to these regulations is paramount, as non-compliance can lead to severe penalties and compromised patient safety. The French government has implemented various initiatives to ensure that medical imaging software meets high-quality standards, which in turn drives demand for compliant solutions. As healthcare providers strive to maintain compliance, the medical imaging-software market is likely to see an increase in demand for software that not only meets regulatory requirements but also enhances operational efficiency.

Technological Advancements in Imaging Techniques

The medical imaging-software market is experiencing a surge due to rapid technological advancements in imaging techniques. Innovations such as 3D imaging, MRI, and CT scans are becoming increasingly sophisticated, enhancing diagnostic accuracy. In France, the adoption of advanced imaging modalities is projected to grow by approximately 15% annually, driven by the need for precise diagnostics in healthcare. This growth is further supported by the integration of software solutions that facilitate image processing and analysis, thereby improving workflow efficiency in medical facilities. As hospitals and clinics invest in state-of-the-art imaging technologies, the demand for compatible software solutions is likely to rise, propelling the medical imaging-software market forward.