Increased Healthcare Expenditure

The rising healthcare expenditure in France is a significant driver for the respiratory drugs market. The French government has committed to increasing healthcare budgets, with a focus on improving access to essential medications and treatments. In 2025, healthcare spending is projected to reach €300 billion, reflecting a 4% increase from previous years. This financial commitment is likely to enhance the availability of respiratory drugs, particularly for chronic conditions that require long-term management. Additionally, public health initiatives aimed at reducing the burden of respiratory diseases are expected to further support market growth. As healthcare resources become more accessible, patients will likely experience improved access to necessary respiratory medications, thereby driving demand in the respiratory drugs market.

Advancements in Drug Delivery Systems

Innovations in drug delivery systems are significantly influencing the respiratory drugs market. The development of advanced inhalation devices, such as dry powder inhalers and nebulizers, enhances the efficacy and patient compliance of respiratory medications. These devices allow for targeted delivery of drugs directly to the lungs, improving therapeutic outcomes. In France, the market for inhalation devices is expected to grow at a CAGR of 6% over the next five years, driven by technological advancements and increased patient awareness. Moreover, the integration of smart technology in inhalers, which provides real-time feedback to patients, is likely to further boost adherence to treatment regimens. As a result, the respiratory drugs market is poised for growth, with manufacturers investing in research and development to create more effective delivery systems.

Growing Prevalence of Respiratory Diseases

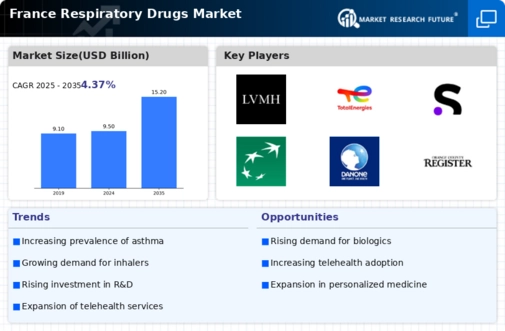

The rising incidence of respiratory diseases in France is a primary driver for the respiratory drugs market. Conditions such as asthma and chronic obstructive pulmonary disease (COPD) are increasingly prevalent, affecting millions of individuals. According to recent health statistics, approximately 3.5 million people in France suffer from asthma, while COPD affects around 1.5 million. This growing patient population necessitates the development and availability of effective respiratory drugs, thereby propelling market growth. Furthermore, the aging population in France, which is projected to reach 20% by 2030, is likely to exacerbate the demand for respiratory medications. As the respiratory drugs market expands, pharmaceutical companies are focusing on innovative therapies to address these chronic conditions, indicating a robust future for the industry.

Rising Awareness and Education Initiatives

There is a growing emphasis on awareness and education initiatives regarding respiratory health in France, which is positively impacting the respiratory drugs market. Public health campaigns aimed at educating the population about the risks and management of respiratory diseases are becoming more prevalent. These initiatives are designed to inform patients about the importance of early diagnosis and adherence to treatment plans. As awareness increases, more individuals are likely to seek medical advice and treatment for respiratory conditions, leading to higher demand for respiratory drugs. Furthermore, healthcare professionals are being trained to better recognize and manage these diseases, which may contribute to improved patient outcomes. Consequently, the respiratory drugs market is expected to benefit from this heightened focus on education and awareness.

Regulatory Support for Innovative Therapies

Regulatory bodies in France are increasingly supportive of innovative therapies in the respiratory drugs market. The French National Agency for the Safety of Medicines and Health Products (ANSM) has streamlined the approval process for new medications, particularly those addressing unmet medical needs. This regulatory environment encourages pharmaceutical companies to invest in research and development, leading to the introduction of novel therapies. For instance, recent approvals for biologics and biosimilars have expanded treatment options for patients with severe asthma and COPD. The potential for faster market entry of innovative drugs is likely to stimulate competition and drive growth in the respiratory drugs market. As a result, patients in France may benefit from a wider array of treatment options, enhancing overall health outcomes.

Leave a Comment