Expansion of IoT Devices in Retail

The proliferation of Internet of Things (IoT) devices is significantly influencing the retail edge-computing market. In France, the number of connected devices in retail environments is expected to reach 500 million by 2025. This expansion allows retailers to gather vast amounts of data from various sources, including smart shelves and connected point-of-sale systems. The integration of edge-computing solutions enables real-time data processing, which is essential for optimizing inventory management and enhancing customer experiences. Consequently, the retail edge-computing market is likely to benefit from this trend, as retailers seek to harness the power of IoT to drive operational efficiencies and improve service delivery.

Rising Demand for Real-Time Analytics

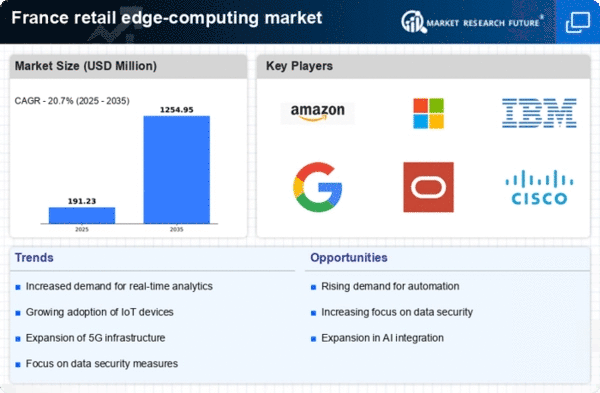

The retail edge-computing market is experiencing a notable surge in demand for real-time analytics. Retailers are increasingly seeking to leverage data at the edge to enhance decision-making processes. This trend is driven by the need for immediate insights into customer behavior and inventory management. In France, the retail sector is projected to invest approximately €1.5 billion in edge-computing solutions by 2026, reflecting a compound annual growth rate (CAGR) of around 20%. This investment is likely to facilitate faster data processing and improve operational efficiency, thereby enabling retailers to respond swiftly to market changes. As a result, the retail edge-computing market is poised for significant growth, driven by the necessity for timely and actionable data.

Growing Importance of Customer Insights

The retail edge-computing market is increasingly shaped by the growing importance of customer insights. Retailers are recognizing the value of understanding consumer preferences and behaviors to tailor their offerings effectively. In France, the market for customer analytics solutions is anticipated to reach €1 billion by 2025, indicating a robust demand for technologies that facilitate data-driven decision-making. By leveraging edge-computing capabilities, retailers can analyze customer data in real-time, allowing for personalized marketing strategies and improved customer engagement. This focus on customer insights is likely to drive the retail edge-computing market, as businesses strive to enhance their competitive edge through data utilization.

Increased Focus on Operational Efficiency

The retail edge-computing market is witnessing a heightened emphasis on operational efficiency among retailers. As competition intensifies, businesses are compelled to streamline their operations to reduce costs and enhance productivity. In France, retailers are projected to allocate around €800 million towards edge-computing technologies by 2025, aiming to automate processes and minimize latency in data processing. This investment is expected to yield substantial returns, as retailers can optimize supply chain management and improve customer service. The drive for operational efficiency is likely to propel the retail edge-computing market forward, as companies adopt innovative solutions to remain competitive in a rapidly evolving landscape.

Regulatory Compliance and Data Governance

The retail edge-computing market is significantly influenced by the need for regulatory compliance and data governance. With increasing scrutiny on data privacy and protection, retailers in France are compelled to adopt edge-computing solutions that ensure compliance with regulations such as the General Data Protection Regulation (GDPR). This regulatory landscape is expected to drive investments in secure edge-computing technologies, with projections indicating a market value of €600 million by 2025. Retailers are likely to prioritize solutions that not only enhance operational capabilities but also safeguard customer data. Consequently, the emphasis on regulatory compliance is poised to shape the retail edge-computing market, as businesses navigate the complexities of data governance.