Growing Awareness of Security Risks

There is a rising awareness of security risks among businesses and individuals in France, which is driving growth in the security system-integrators market. As incidents of theft, vandalism, and cyber threats become more prevalent, organizations are prioritizing the implementation of comprehensive security measures. This heightened awareness is leading to increased budgets for security solutions, with many companies allocating up to 15% of their operational budgets to security systems. Consequently, integrators are adapting their offerings to meet the evolving needs of clients, focusing on customized solutions that address specific vulnerabilities and enhance overall security posture.

Increased Investment in Smart City Initiatives

The push towards smart city initiatives in France significantly influences the security system-integrators market. Municipalities are increasingly allocating funds to develop integrated security solutions that encompass surveillance, access control, and emergency response systems. This investment is expected to reach approximately €1 billion by 2026, reflecting a commitment to enhancing urban safety and efficiency. As cities evolve, integrators are tasked with creating cohesive systems that can communicate seamlessly, thereby improving response times and resource management. This trend not only bolsters the market but also encourages collaboration among various stakeholders, including government agencies and technology providers.

Technological Advancements in Security Systems

Technological advancements are playing a pivotal role in shaping the security system-integrators market in France. Innovations such as artificial intelligence, machine learning, and cloud-based solutions are revolutionizing the way security systems are designed and implemented. These technologies enable more efficient monitoring, data analysis, and threat detection, which are crucial for modern security needs. The integration of AI-driven analytics is expected to enhance the effectiveness of surveillance systems, potentially reducing false alarms by up to 30%. As these technologies become more accessible, integrators are likely to leverage them to offer cutting-edge solutions that meet the demands of a tech-savvy clientele.

Expansion of Regulatory Compliance Requirements

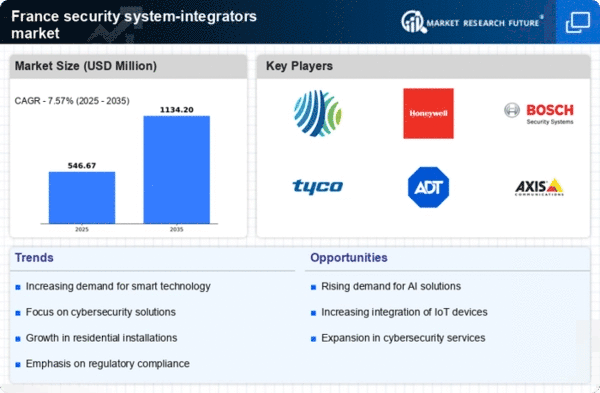

The expansion of regulatory compliance requirements in France is significantly impacting the security system-integrators market. Organizations are increasingly required to adhere to stringent regulations regarding data protection and privacy, particularly in sectors such as finance and healthcare. This has led to a surge in demand for security systems that not only protect physical assets but also ensure compliance with legal standards. As a result, integrators are focusing on developing solutions that incorporate robust data security features, thereby enhancing their value proposition. The market is expected to grow at a rate of 8% as companies seek to align their security measures with evolving regulatory frameworks.

Rising Demand for Advanced Surveillance Solutions

The security system-integrators market in France is experiencing a notable increase in demand for advanced surveillance solutions. This trend is driven by the growing need for enhanced security measures across various sectors, including commercial, residential, and public spaces. As crime rates fluctuate, businesses and homeowners are investing in sophisticated surveillance systems to deter criminal activities. According to recent data, the market for video surveillance equipment is projected to grow at a CAGR of 10% over the next five years. This surge in demand is compelling integrators to adopt innovative technologies, thereby expanding their service offerings and improving overall market competitiveness.

Leave a Comment