Government Initiatives and Funding

Government initiatives aimed at promoting health and wellness through sports are likely to bolster the sports medicine market in France. The French government has implemented various programs to encourage physical activity, which in turn increases the prevalence of sports-related injuries. Funding for sports facilities and healthcare services is also on the rise, with an estimated €200 million allocated annually to support sports medicine research and development. This financial backing not only enhances the infrastructure for sports medicine but also encourages innovation in treatment methodologies. As a result, the sports medicine market is expected to benefit from these initiatives, leading to improved access to care and advanced treatment options for athletes.

Growing Awareness of Sports Injuries

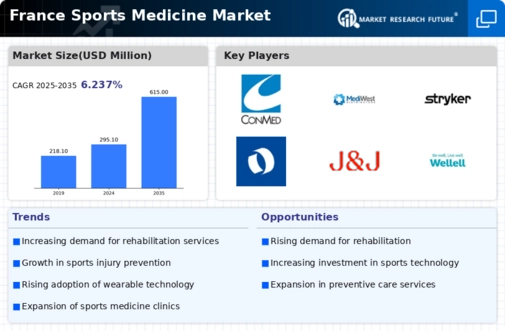

There appears to be a growing awareness among athletes and the general public regarding the importance of addressing sports injuries promptly and effectively. This heightened awareness is driving demand for specialized sports medicine services in France. Educational campaigns and increased media coverage about the risks associated with sports injuries have contributed to this trend. As a result, more individuals are seeking professional help for injury prevention and rehabilitation, which is likely to expand the sports medicine market. Furthermore, the increasing prevalence of sports injuries, estimated to affect around 30% of athletes annually, underscores the necessity for comprehensive medical care, thereby reinforcing the market's growth potential.

Advancements in Rehabilitation Techniques

Advancements in rehabilitation techniques and technologies are significantly influencing the sports medicine market in France. Innovative approaches, such as the use of virtual reality and biofeedback systems, are being integrated into rehabilitation programs, enhancing recovery outcomes for athletes. These advancements not only improve the efficiency of treatment but also attract more athletes seeking effective rehabilitation solutions. The market for rehabilitation equipment is projected to grow by approximately 15% annually, reflecting the increasing investment in cutting-edge technologies. As rehabilitation becomes more personalized and effective, the sports medicine market is likely to experience substantial growth, driven by the demand for these advanced treatment options.

Rising Participation in Sports Activities

The increasing participation in various sports activities in France appears to be a primary driver for the sports medicine market. As more individuals engage in sports, the demand for specialized medical services and products tailored to athletes rises. According to recent data, approximately 40% of the French population participates in some form of sport, leading to a heightened need for injury management and rehabilitation services. This trend suggests that healthcare providers and sports medicine professionals must adapt to cater to a growing clientele, thereby expanding the market. Furthermore, the emphasis on fitness and well-being among the youth is likely to contribute to sustained growth in the sports medicine market, as younger athletes often require specialized care to prevent and treat injuries effectively.

Integration of Sports Medicine in Educational Institutions

The integration of sports medicine programs within educational institutions in France is emerging as a crucial driver for the sports medicine market. Schools and universities are increasingly recognizing the importance of providing students with access to sports medicine professionals, thereby fostering a culture of health and safety in sports. This trend is likely to lead to a greater demand for sports medicine services, as educational institutions seek to ensure the well-being of their student-athletes. With an estimated 1.5 million students participating in organized sports at the collegiate level, the potential market for sports medicine services within educational settings is substantial. This integration not only enhances the visibility of sports medicine but also encourages early intervention and preventive care, further propelling market growth.