Rising Cybersecurity Threats

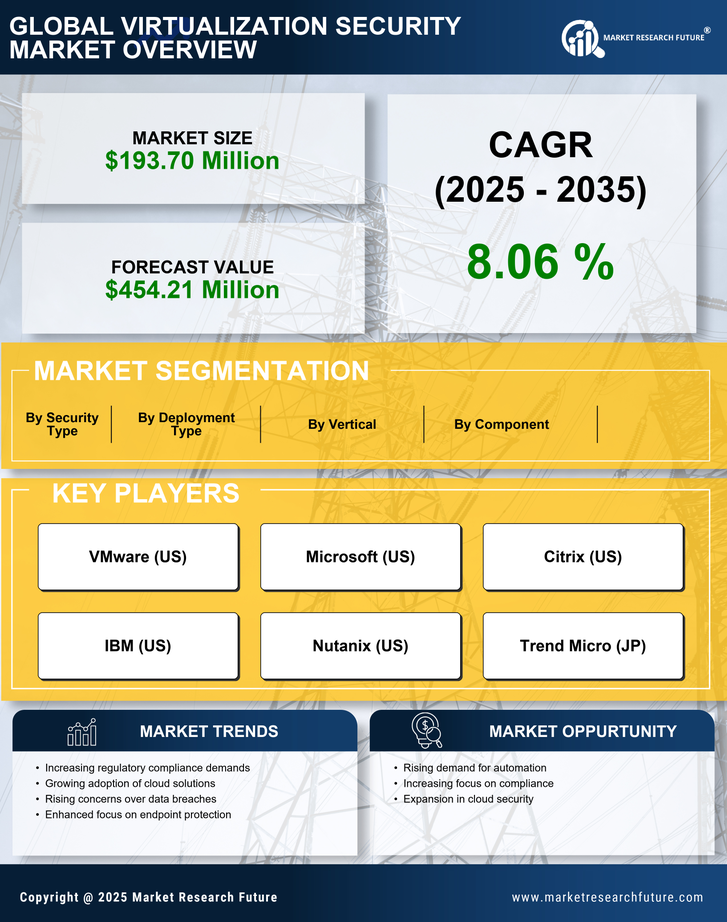

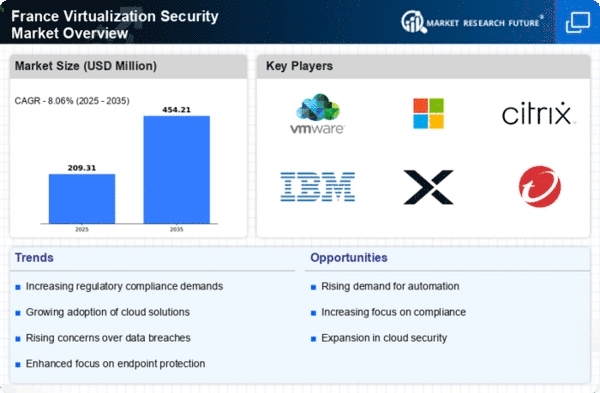

The market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats.. Organizations are recognizing the necessity of robust security measures to protect their virtual environments. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting French companies to invest significantly in virtualization security solutions. This trend indicates a growing awareness of the vulnerabilities associated with virtualization technologies, leading to a surge in the adoption of security protocols and tools designed to safeguard virtual infrastructures. As a result, the virtualization security market is likely to expand as businesses prioritize the protection of sensitive data and critical applications.

Regulatory Pressures and Compliance

In France, regulatory frameworks such as the General Data Protection Regulation (GDPR) impose stringent requirements on organizations regarding data protection and privacy. This regulatory landscape drives the virtualization security market as companies strive to comply with legal obligations. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. Consequently, businesses are increasingly investing in virtualization security solutions to ensure adherence to these regulations. The need for compliance not only enhances the security posture of organizations but also fosters trust among customers, thereby propelling the growth of the virtualization security market in France.

Shift Towards Remote Work Environments

The virtualization security market in France is significantly influenced by the ongoing shift towards remote work. As organizations adopt flexible work arrangements, the reliance on virtualized environments increases, necessitating enhanced security measures. According to recent studies, approximately 30% of the French workforce is expected to work remotely by 2025, which raises concerns about securing remote access to virtualized resources. This trend compels businesses to invest in comprehensive virtualization security solutions that protect against unauthorized access and data breaches. The growing need for secure remote work environments is likely to drive the virtualization security market as organizations seek to mitigate risks associated with remote operations.

Increased Investment in IT Infrastructure

The virtualization security market in France is experiencing growth due to increased investment in IT infrastructure. Organizations are modernizing their IT environments to enhance efficiency and scalability, which often involves the adoption of virtualization technologies. According to industry reports, IT spending in France is expected to reach €60 billion by 2025, with a significant portion allocated to security solutions. This investment trend reflects a broader recognition of the importance of securing virtualized environments against emerging threats. As companies prioritize the development of robust IT infrastructures, the demand for virtualization security solutions is likely to rise, further propelling the market forward.

Technological Advancements in Security Solutions

The virtualization security market in France is benefiting from rapid technological advancements in security solutions. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into virtualization security tools, enhancing their effectiveness in threat detection and response. In 2025, it is projected that the AI security market could reach $38 billion, indicating a strong trend towards adopting intelligent security measures. These advancements enable organizations to proactively identify vulnerabilities and respond to threats in real-time, thereby strengthening their security posture. As businesses increasingly recognize the value of advanced security technologies, the virtualization security market is poised for substantial growth.