Emerging Trends in Cybersecurity

The evolving landscape of cybersecurity is significantly influencing the zero touch-provisioning market in France. As cyber threats become more sophisticated, organizations are increasingly prioritizing security in their IT strategies. Zero touch-provisioning solutions inherently support enhanced security measures by automating device configurations and ensuring compliance with security protocols. This capability is particularly relevant in sectors such as finance and healthcare, where data protection is paramount. Recent reports indicate that investments in cybersecurity solutions are expected to rise by 25% in the coming years, which may drive further adoption of zero touch-provisioning technologies. As businesses recognize the importance of integrating security into their provisioning processes, the zero touch-provisioning market is likely to benefit from this heightened focus on cybersecurity.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the zero touch-provisioning market in France. Organizations are continually seeking ways to reduce operational expenses while maintaining high service levels. Zero touch-provisioning solutions offer a compelling value proposition by minimizing the need for manual intervention in device setup and management. This automation not only reduces labor costs but also accelerates deployment times, allowing businesses to respond more swiftly to market demands. Recent studies indicate that companies implementing zero touch-provisioning can achieve cost savings of up to 30% in their IT operations. As businesses strive to enhance their bottom line, the zero touch-provisioning market is likely to see increased adoption as a strategic approach to achieving greater cost efficiency.

Growing Integration with Cloud Services

The integration of zero touch-provisioning solutions with cloud services is emerging as a significant driver in the French market. As more organizations migrate their operations to the cloud, the need for seamless device provisioning becomes increasingly critical. Zero touch-provisioning facilitates this integration by enabling devices to be automatically configured and managed through cloud platforms. This capability not only simplifies the deployment process but also enhances scalability and flexibility for businesses. The cloud services market in France is projected to grow at a CAGR of 20%, which suggests a corresponding increase in the demand for zero touch-provisioning solutions that can effectively support cloud-based operations. Consequently, the zero touch-provisioning market is likely to expand as organizations seek to leverage the benefits of cloud technology.

Rising Demand for Remote Management Solutions

The zero touch-provisioning market in France is experiencing a notable surge in demand for remote management solutions. As organizations increasingly adopt remote work policies, the need for efficient device management has become paramount. This trend is reflected in the growing number of enterprises seeking to streamline their IT operations, thereby reducing the need for on-site technical support. According to recent data, the market for remote management solutions is projected to grow by approximately 15% annually, indicating a robust shift towards zero touch-provisioning methodologies. This shift not only enhances operational efficiency but also aligns with the broader digital transformation initiatives being undertaken across various sectors in France. Consequently, the zero touch-provisioning market is poised to benefit significantly from this rising demand, as businesses look for ways to optimize their IT infrastructure while minimizing costs.

Government Initiatives Supporting Digital Transformation

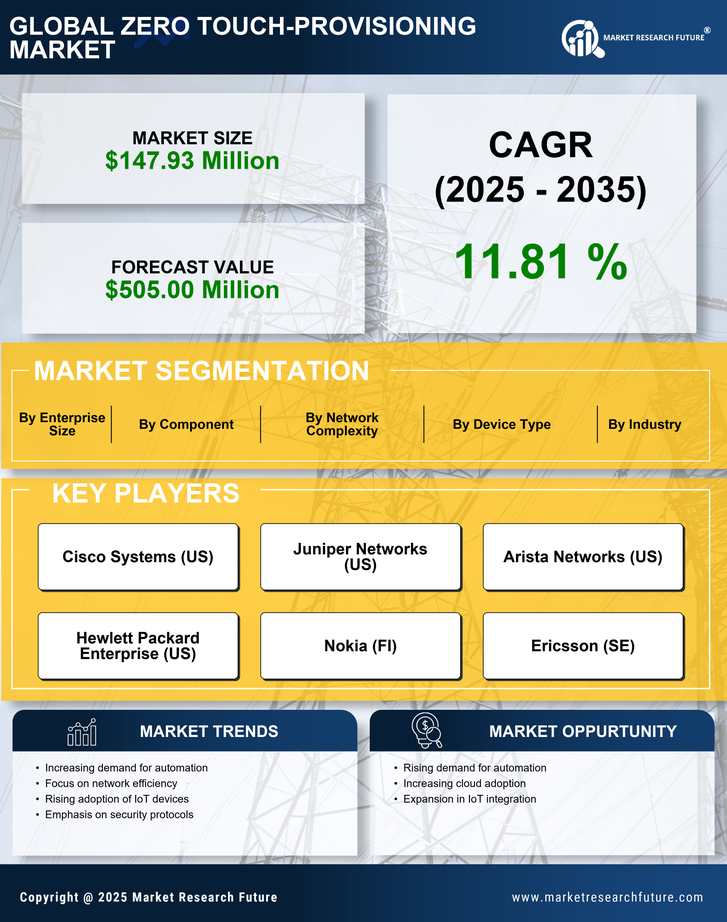

In France, government initiatives aimed at promoting digital transformation are playing a crucial role in the growth of the zero touch-provisioning market. The French government has launched several programs designed to encourage businesses to adopt advanced technologies, including zero touch-provisioning solutions. These initiatives often include financial incentives, grants, and support for research and development. As a result, many organizations are increasingly investing in zero touch-provisioning technologies to comply with government mandates and to enhance their operational capabilities. The market is expected to see a compound annual growth rate (CAGR) of around 12% over the next few years, driven by these supportive policies. This environment fosters innovation and encourages the adoption of zero touch-provisioning solutions, thereby solidifying their importance in the overall digital landscape of France.