E-commerce Growth

The rapid expansion of e-commerce platforms is reshaping the fresh processed meat product Market. With the convenience of online shopping, consumers are increasingly purchasing meat products through digital channels. Recent statistics indicate that online sales of fresh processed meats have grown by over 25% in the last year, driven by the pandemic-induced shift towards online grocery shopping. Retailers are investing in robust logistics and supply chain solutions to ensure the freshness and quality of products delivered to consumers' doorsteps. This trend suggests that the Fresh Processed Meat Product Market will continue to evolve, as companies enhance their online presence and adapt to changing consumer behaviors.

Health-Conscious Offerings

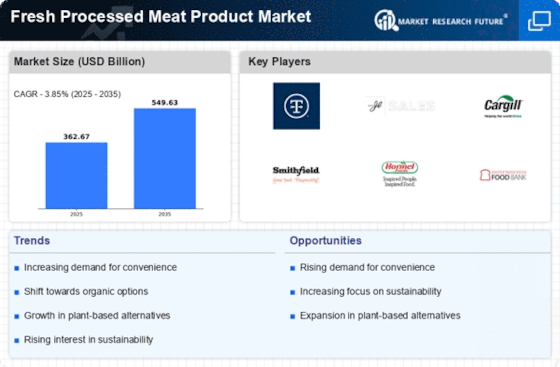

The increasing consumer inclination towards health-conscious diets appears to be a pivotal driver for the Fresh Processed Meat Product Market. As individuals become more aware of the nutritional content of their food, there is a growing demand for meat products that are lower in fat and sodium, yet high in protein. This trend is reflected in market data, which indicates that the sales of lean meats and organic options have surged by approximately 20% over the past year. Manufacturers are responding by reformulating products to meet these health standards, thereby expanding their market share. The Fresh Processed Meat Product Market is likely to see continued growth as consumers prioritize health and wellness in their dietary choices.

Sustainability Initiatives

Sustainability initiatives are increasingly influencing consumer purchasing decisions within the Fresh Processed Meat Product Market. As environmental concerns rise, consumers are gravitating towards brands that demonstrate a commitment to sustainable practices, such as responsible sourcing and reduced carbon footprints. Recent data suggests that nearly 30% of consumers are willing to pay a premium for sustainably sourced meat products. This shift is prompting companies to adopt eco-friendly practices, including the use of renewable energy in production and sustainable packaging solutions. Consequently, the Fresh Processed Meat Product Market is likely to experience a transformation as brands align their operations with sustainability goals, appealing to a more environmentally conscious consumer base.

Culinary Trends and Innovations

Culinary trends and innovations are playing a crucial role in shaping the Fresh Processed Meat Product Market. As consumers seek diverse and exciting flavors, manufacturers are introducing new products that cater to evolving tastes. The rise of international cuisines and gourmet offerings has led to an increase in demand for specialty processed meats, such as artisanal sausages and marinated cuts. Market data indicates that the specialty meat segment has seen a growth rate of approximately 15% annually. This trend suggests that the Fresh Processed Meat Product Market will continue to thrive as companies innovate and diversify their product lines to meet consumer preferences.

Convenience and Ready-to-Eat Options

The demand for convenience and ready-to-eat options is a significant driver in the Fresh Processed Meat Product Market. Busy lifestyles and the need for quick meal solutions have led consumers to seek out pre-packaged and easy-to-prepare meat products. Recent market analysis shows that ready-to-eat meat products have experienced a growth rate of around 18% in the past year. This trend is prompting manufacturers to develop a variety of convenient offerings, such as pre-marinated meats and fully cooked options. As consumer preferences continue to shift towards convenience, the Fresh Processed Meat Product Market is likely to adapt, ensuring that it meets the needs of time-strapped consumers.

.png)