Frozen Dessert Size

Frozen Dessert Market Growth Projections and Opportunities

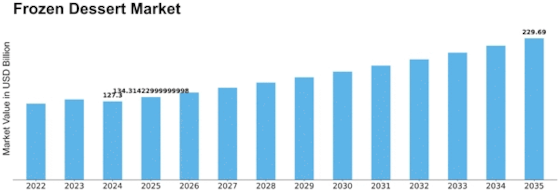

The Frozen Desserts Market is influenced by a myriad of market factors that collectively shape its dynamics and growth trajectory. One pivotal factor adding to the expansiveness of the market is a change in consumer tastes and dietary patterns. The worldwide Frozen Dessert Market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 5.82%, reaching a market value of USD 178.74 Billion by the year 2030. A wide range of frozen desserts encompassing liquids, semi-solid mixes, and even solid ones are made in this process. Furthermore, there is a huge impact on the market due to product innovation and differentiation trends, among other factors that have seen producers come up with new flavors, textures, and formats that will catch the attention of customers away from traditional ice creams alone up to pudding, custard, and ice cream cake as frozen desserts. This pursuit for innovation includes an array of products beyond just ice creams, such as puddings, custards, and ice cream cakes. Manufacturers are always experimenting with various flavors, textures, or formats which can attract consumers' interest. The reason behind this approach is that in addition to traditional ice cream, manufacturers offer an assortment of frozen desserts, including gelatins, puddings, flans custards, mousses semifreddos, sundaes, etc. The benefit offered by such rich product offering sources is increasing the consumer base or retaining customer loyalty. Another influential factor in this industry's growth concerns geographical distribution. Consequently, regional preferences, weather conditions, and economic factors generally govern growth within the frozen dessert markets. In hotter climates, there tends to be more demand for frozen treats since many people want something refreshing and cooling. Government regulations also play quite some role when it comes to shaping the Frozen Desserts Market. Among others, these include health & safety standards, labeling requirements, restrictions on certain ingredients that affect manufacturing distribution marketing, etc. Compliance with these regulations not only ensures product quality but also influences brand reputation. The retail landscape is also an influential factor in market dynamics. The frozen desserts being accessible and available through various retail channels such as supermarkets, convenience stores, and online platforms significantly determine their popularity. Furthermore, the impact of marketing and promotional strategies can never be underestimated regarding this issue. Effective marketing campaigns, branding initiatives, and promotional activities contribute to creating awareness and driving consumer preferences. Pricing is a primary economic factor in market dynamics as well. The Frozen Desserts Market is particularly sensitive to changes in ingredient prices, production costs, or other economic factors that may influence customers' purchasing power. Businesses must balance the availability of high-quality products with competitive pricing for sustainable growth.

Leave a Comment