Rising Demand for Lightweight Materials

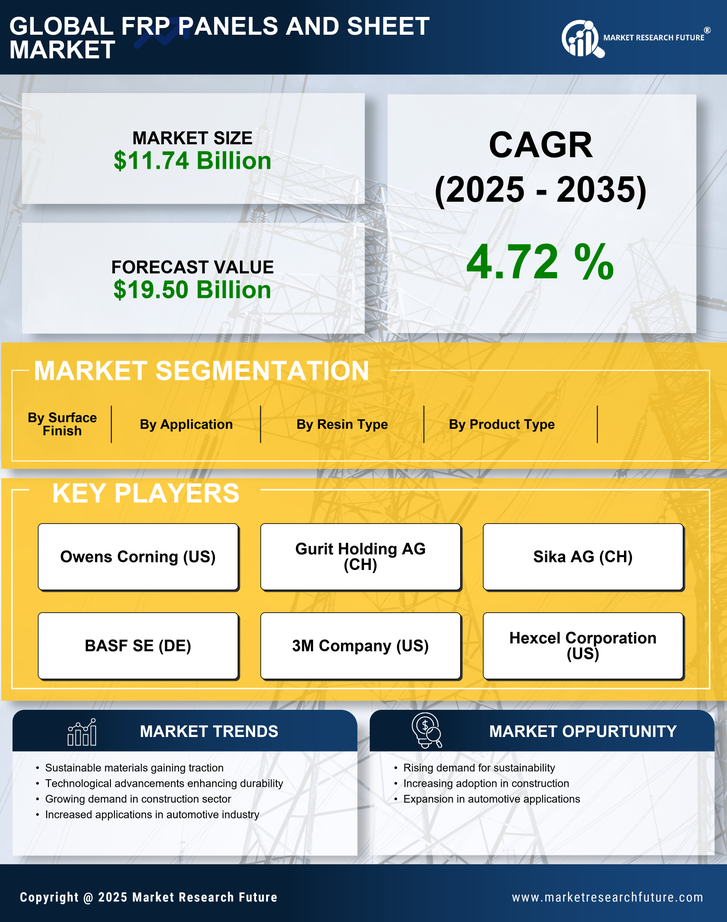

The increasing demand for lightweight materials in various industries appears to be a significant driver for the FRP Panels and Sheet Market. As sectors such as construction, automotive, and aerospace seek to enhance fuel efficiency and reduce overall weight, the adoption of fiberglass reinforced plastic (FRP) panels is likely to rise. The lightweight nature of FRP materials not only contributes to energy savings but also improves structural performance. Recent data indicates that the construction sector alone is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% over the next five years, further bolstering the demand for FRP panels. This trend suggests that manufacturers in the FRP Panels and Sheet Market may need to innovate continuously to meet the evolving needs of their clients.

Growing Applications in Renewable Energy Sector

The expanding applications of FRP panels in the renewable energy sector appear to be a promising driver for the FRP Panels and Sheet Market. With the global shift towards sustainable energy sources, FRP materials are increasingly utilized in wind turbine blades, solar panel structures, and other renewable energy applications. The lightweight and corrosion-resistant properties of FRP make it an ideal choice for these applications, enhancing efficiency and longevity. Market forecasts suggest that the renewable energy sector will continue to grow, with investments in wind and solar energy projected to increase significantly. This trend indicates that the FRP Panels and Sheet Market could experience substantial growth as it aligns with the needs of the renewable energy market.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are likely to enhance the capabilities of the FRP Panels and Sheet Market. Innovations such as automated production techniques and advanced composite materials are improving the efficiency and quality of FRP products. These developments not only reduce production costs but also enable the creation of customized solutions tailored to specific applications. As industries demand higher performance and specialized products, manufacturers in the FRP Panels and Sheet Market may find opportunities to expand their offerings. The integration of smart technologies in production could further streamline operations, potentially leading to a more competitive market landscape.

Regulatory Support for Sustainable Building Practices

Regulatory frameworks promoting sustainable building practices are emerging as a crucial driver for the FRP Panels and Sheet Market. Governments and regulatory bodies are increasingly mandating the use of eco-friendly materials in construction projects, which aligns well with the properties of FRP panels. These materials are often recyclable and can contribute to energy-efficient building designs. Recent legislation in various regions has set ambitious targets for reducing carbon footprints, which may lead to a surge in demand for sustainable materials like FRP. The construction industry is projected to see a shift towards greener practices, with the FRP Panels and Sheet Market positioned to capitalize on this regulatory momentum.

Increased Focus on Durability and Corrosion Resistance

The emphasis on durability and corrosion resistance in construction and industrial applications is likely to propel the FRP Panels and Sheet Market forward. FRP materials are known for their exceptional resistance to harsh environmental conditions, making them suitable for use in chemical plants, marine environments, and other corrosive settings. This durability translates into lower maintenance costs and longer service life, which are appealing attributes for end-users. Market analysis indicates that the industrial sector is expected to account for a substantial share of the FRP market, with a projected growth rate of around 6% annually. As industries increasingly prioritize longevity and performance, the FRP Panels and Sheet Market stands to benefit significantly from this trend.