Research Methodology on Full Service Carrier Market

Market research is a method used to collect information to make informed decisions. It involves gathering data on customer preferences, trends, and competitor marketing strategies which can be used to develop strategies for a product or service. The purpose of this research methodology is to provide a detailed overview of the full-service carrier market, its drivers, restraints, trends, opportunities, and competitive landscape.

This study is conducted with a research approach of both primary and secondary sources. An exhaustive search of secondary sources such as the database of the World Bank, industry websites, press releases, and journals was conducted to get a lay of the land surrounding the full-service carrier market. Additionally, webinars and interviews with industry experts, business owners, and decision-makers were used to gain insight into the current trends in the market.

Primary research involves interaction with the key players in the industry to understand their offerings and customer needs. Companies profiled in this report include JetBlue Airways, Emirates Airline, British Airways, KLM, and Lufthansa. The interviews were held at their premises or over the phone, as appropriate. The insights gained from these interviews were collated to get a comprehensive view of the market dynamics and competitive landscape.

The primary question being answered in this research report is What are the key drivers and restraints that drive the full-service carrier market? To answer this question, a combination of qualitative and quantitative research approaches was used. A top-down approach was taken to provide an overall market size. A bottom-up approach was also taken to build a comprehensive story of the market opportunity.

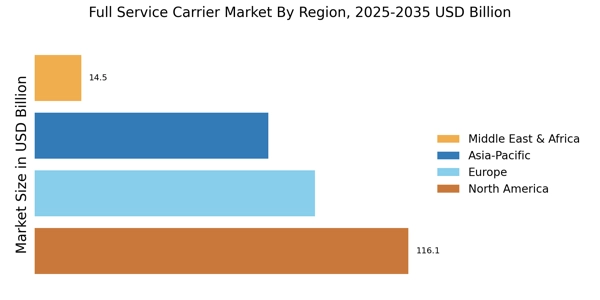

The top-down approach began with published figures on passenger traffic in different countries, focusing on regions such as North America, Europe, Asia-Pacific, and the Rest of the World. This information was used to verify the qualitative data collected from the interviews and secondary sources.

The bottom-up approach, on the other hand, began with the market size for the regional markets, followed by splitting that market based on the different types of carriers and the countries within the region. Detailed information regarding the different countries and their respective carriers was obtained from the World Bank database and various other reports. The market size is arrived at through end-user analysis to understand the growth of the market over the forecast period 2023 to 2030.

In addition to the top-down and bottom-up approaches, a factor analysis component was also included to get a better understanding of the drivers and restraints affecting the full-service carrier market. This analysis was conducted by examining customer surveys, customer feedback, focus groups, and pricing studies.

Finally, time-series analysis was used to understand the patterns of consumer behaviour in the full-service carrier market. Time series analysis was undertaken to better understand the historical growth trends of the market, its current status, and its projected growth.

To further validate the various data sources, demand-side and supply-side data triangulation was employed. Supply-side triangulation was used to understand the supply chain and the channel dynamics in the full-service carrier market. This was done by looking at the distribution channels, major suppliers, and the pricing strategies undertaken by each of them. Demand-side triangulation was used to understand consumer behaviour towards specific product and service offerings in the market. This was done by gathering primary and secondary data in order to develop an understanding of the target audience and their preferences.

Detailed and comprehensive research methodology was employed in this study to understand and analyze the full-service carrier market and its growth dynamics. The various research methodologies used in combination have enabled us to get a 360-degree view of the market in terms of its drivers, restraints, and opportunities in the near future.