- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

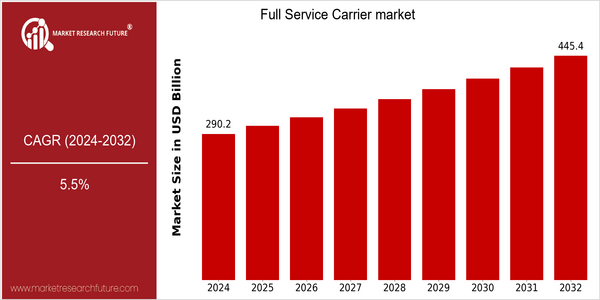

| Year | Value |

|---|---|

| 2024 | USD 290.23 Billion |

| 2032 | USD 445.412 Billion |

| CAGR (2024-2032) | 5.5 % |

Note – Market size depicts the revenue generated over the financial year

The Full Service Carriers (FSC) market is expected to grow significantly with a current market size of $ 290.23 billion in 2024, and is expected to reach $ 445.412 billion by 2032. The CAGR of 5.5% is a strong and steady annual growth rate. The main reason for this is the rising demand for air travel, which is mainly driven by rising incomes and the growing middle class in emerging economies. The development of aviation technology, such as the development of fuel-efficient aircraft and the development of passenger services, is also expected to drive the growth of the industry. The major players in the FSC market, such as Delta Air Lines, Air France, and Emirates, are also investing in the development of aircraft and digitalization, and are committed to improving customer experience and enhancing operational efficiency. Strategic alliances, such as code-sharing agreements and joint ventures, are also becoming more and more common. , in order to expand the global layout and optimize the service. These efforts not only enhance the competitiveness of the company, but also drive the overall development of the industry, which is in line with the trend of the industry.

Regional Market Size

Regional Deep Dive

The Full Service Airline (FSC) market is characterized by a highly competitive landscape, mainly driven by increasing passenger traffic, changing passenger preferences and technological advancements. FSCs in North America, Europe, Asia-Pacific, Middle East and Africa (MEA) and Latin America are coping with these market dynamics by enhancing the customer experience, expanding the network and investing in the sustainable development of the industry. Each region is characterized by its own cultural, regulatory and economic conditions, which shape the operational strategies of the main players in the market.

Europe

- European FSCs are increasingly focusing on digital transformation, with airlines like Lufthansa and British Airways investing in advanced customer service technologies, such as AI-driven chatbots and personalized travel experiences.

- The European Union's Green Deal is pushing airlines to adopt more environmentally friendly practices, leading to innovations in aircraft design and operational efficiency, which are expected to reshape the competitive landscape.

Asia Pacific

- In Asia-Pacific, the rise of low-cost carriers is prompting FSCs like Singapore Airlines to enhance their service offerings and loyalty programs to retain market share, leading to a more competitive environment.

- Government initiatives, such as the Asia-Pacific Economic Cooperation (APEC) travel facilitation programs, are expected to boost air travel demand, further stimulating growth in the FSC sector.

Latin America

- Latin American FSCs are focusing on partnerships and alliances, with airlines like LATAM and Avianca forming strategic alliances to enhance their network and service offerings, responding to competitive pressures from low-cost carriers.

- Regulatory changes aimed at liberalizing air travel in countries like Brazil are expected to increase competition and improve service quality, benefiting consumers in the region.

North America

- The North American FSC market is undergoing a significant shift towards greater responsibility. Delta Air Lines and United Airlines have committed themselves to achieving net zero emissions by 2050, which has led to the introduction of more fuel-efficient aircraft and sustainable jet fuels.

- Regulatory changes, such as the implementation of the FAA's new safety regulations, are enhancing operational standards, which is expected to improve overall service quality and safety in the region.

Middle East And Africa

- Middle Eastern airlines, particularly Emirates and Qatar Airways, are expanding their global reach by increasing flight frequencies and launching new routes, capitalizing on their strategic geographic locations.

- The region's investment in airport infrastructure, exemplified by projects like the expansion of Dubai International Airport, is expected to enhance connectivity and passenger experience, driving growth in the FSC market.

Did You Know?

“Did you know that the average age of commercial aircraft in the global fleet is around 12 years, but many Full Service Carriers are investing in newer, more fuel-efficient models to reduce operational costs and environmental impact?” — International Air Transport Association (IATA)

Segmental Market Size

The full-service carriers are a vital component of the aviation market. They provide the most complete air transport services, including passenger transport, freight transport and other extras. This market segment is currently growing steadily, mainly driven by growing demand for air travel and the improvement in services. The main driving forces behind this are the increasing population of the middle class in emerging markets and the growing preference for premium travel. Also contributing to the trend is the regulatory support for increased air transport. In terms of the development of the full-service carriers, the market is already at a mature stage of development. Major carriers such as Delta Air Lines, Air France, KLM and Emirates are at the forefront of service innovation and customer experience. These carriers operate both domestic and international passenger routes and provide integrated cargo solutions. There are also notable trends that are driving the growth of the full-service carriers. One of them is the introduction of more fuel-efficient aircraft and the use of carbon offsets. Another is the automation of the reservation system and the automation of customer service. These trends are shaping the evolution of the full-service carrier market, making it more competitive and more responsive to customer needs.

Future Outlook

The Full-service carrier (FSC) market is expected to show a robust growth from 2024 to 2032, with a projected market value increase from $290.23 billion to $445.41 billion, indicating a CAGR of 5.5%. The demand for international travel has increased since the end of the pandemic. As the economic recovery continues, confidence in international travel is expected to rise, and restrictions on international travel are expected to be gradually lifted. In 2032, the market penetration rate of FSCs is expected to reach approximately 60% of the total market, driven by the rising popularity of premium service and customer experience. The main driving force of the full-service carrier market in the next five years is expected to be the development of technology and the impact of policy. The fuel-efficient aircraft and sustainable aviation technology are expected to play a key role in reducing the cost of operation and the burden of the environment, and in line with the sustainable development strategy. The government's policy to promote the safety and efficiency of air travel will also boost the market. FSCs are also expected to be able to provide a more individualized travel experience, loyalty programs, and digital transformations for customers, so that they will continue to be the preferred choice for business travelers and tourists who value convenience and safety.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 282.665 Billion |

| Growth Rate | 5.5% (2024-2032) |

Full Service Carrier Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.