Adoption of DevOps Practices

The Full-Stack Observability Services Market is witnessing a significant impact from the widespread adoption of DevOps practices. As organizations strive for faster software delivery and improved collaboration between development and operations teams, the need for observability tools becomes increasingly apparent. These tools facilitate continuous monitoring and feedback loops, enabling teams to identify and resolve issues more efficiently. Recent findings suggest that companies implementing DevOps practices experience a 50% reduction in time to market for new features. This acceleration in development cycles necessitates robust observability solutions that can provide real-time insights into application performance and infrastructure health. The alignment of observability services with DevOps methodologies is likely to drive further innovation and investment in the Full-Stack Observability Services Market.

Demand for Enhanced User Experience

The Full-Stack Observability Services Market is increasingly driven by the demand for enhanced user experience. As customer expectations continue to rise, organizations are compelled to ensure that their applications perform optimally. Observability services play a crucial role in identifying performance bottlenecks and user experience issues. Companies are leveraging these services to gain insights into user behavior and application performance metrics. Data indicates that organizations that invest in observability tools can improve their application performance by up to 30%, leading to higher customer satisfaction and retention rates. This focus on user experience is likely to propel further growth in the observability market, as businesses strive to deliver seamless and engaging digital experiences to their customers.

Rising Demand for Real-Time Monitoring

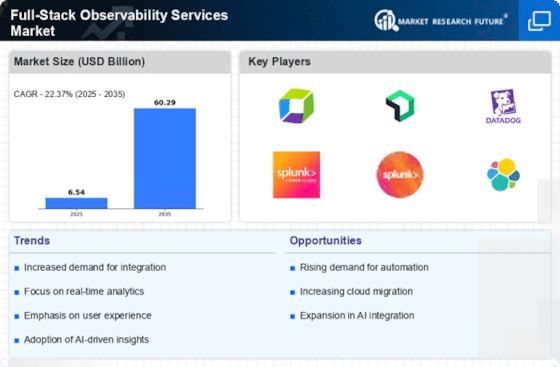

The Full-Stack Observability Services Market is experiencing a notable surge in demand for real-time monitoring solutions. Organizations are increasingly recognizing the necessity of having immediate insights into their application performance and infrastructure health. This trend is driven by the need to enhance user experience and minimize downtime. According to recent data, the market for real-time monitoring tools is projected to grow at a compound annual growth rate of approximately 20% over the next five years. Companies are investing in observability services to ensure that they can proactively address issues before they escalate, thereby maintaining operational efficiency and customer satisfaction. As businesses continue to embrace digital transformation, the importance of real-time monitoring within the Full-Stack Observability Services Market cannot be overstated.

Increased Complexity of IT Environments

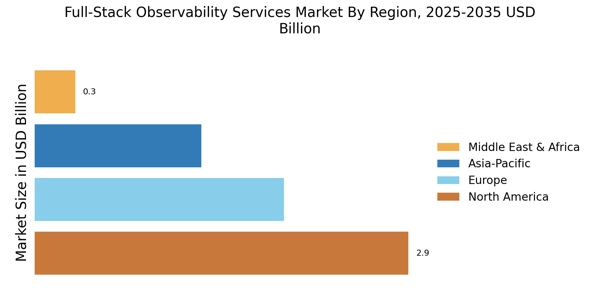

The Full-Stack Observability Services Market is significantly influenced by the growing complexity of IT environments. As organizations adopt multi-cloud strategies and hybrid infrastructures, the need for comprehensive observability solutions becomes paramount. This complexity often leads to challenges in monitoring and managing applications across various platforms. Consequently, businesses are seeking full-stack observability services that can provide a unified view of their entire technology stack. Recent statistics indicate that over 70% of enterprises are now utilizing multiple cloud services, which necessitates advanced observability tools to ensure seamless integration and performance monitoring. The ability to gain insights across diverse environments is likely to drive further investment in observability services, highlighting their critical role in navigating the intricacies of modern IT landscapes.

Growing Emphasis on Security and Compliance

In the Full-Stack Observability Services Market, there is an increasing emphasis on security and compliance. Organizations are becoming more aware of the potential risks associated with data breaches and regulatory non-compliance. As a result, they are prioritizing observability solutions that not only monitor performance but also enhance security posture. The market is witnessing a shift towards integrated observability tools that provide visibility into security vulnerabilities and compliance status. Recent reports suggest that The Full-Stack Observability Services Market is expected to reach USD 300 billion by 2024, indicating a strong correlation between observability services and security needs. This trend underscores the necessity for businesses to adopt comprehensive observability frameworks that address both operational and security challenges, thereby fostering a more resilient IT environment.