Growth in Optical Applications

The Fused Silica Market is significantly influenced by the growing applications in optics. Fused silica is favored for its excellent optical properties, including high transmission in the ultraviolet and infrared ranges. The optical fiber market, which is expected to grow at a CAGR of around 10% through 2025, relies heavily on fused silica for fiber production. This growth indicates a robust demand for fused silica in the production of lenses, prisms, and other optical components, thereby enhancing the overall market landscape.

Increasing Use in Aerospace and Defense

The Fused Silica Market is benefiting from the increasing utilization of fused silica in aerospace and defense applications. The material's lightweight and high thermal stability make it ideal for various components in aircraft and spacecraft. As defense budgets rise and the aerospace sector expands, the demand for advanced materials like fused silica is likely to increase. In 2025, the aerospace market is projected to exceed 800 billion USD, suggesting a substantial opportunity for the Fused Silica Market to cater to this growing sector.

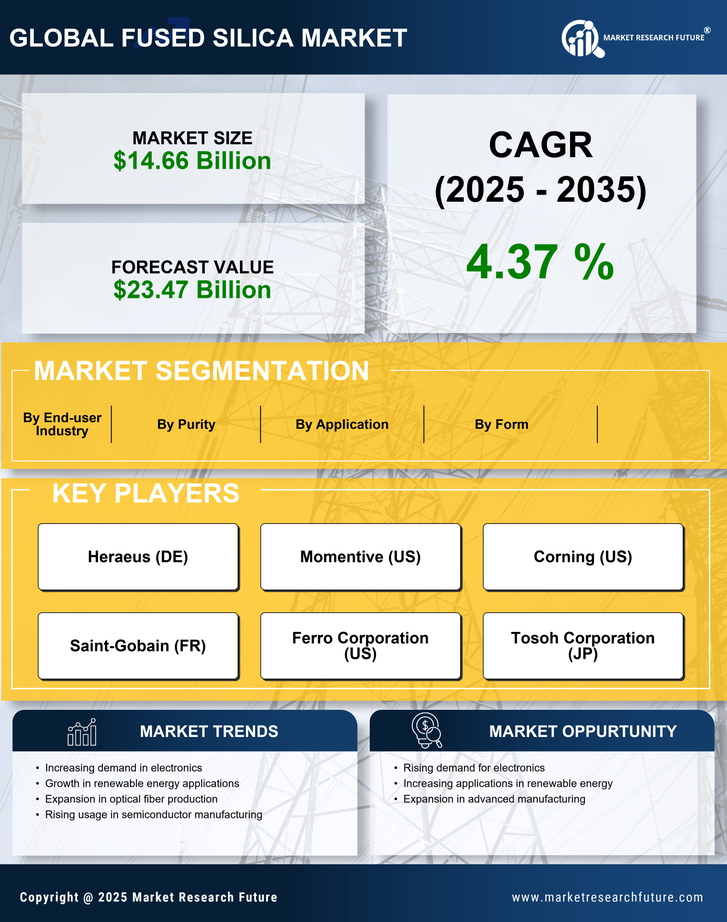

Rising Demand in Semiconductor Industry

The Fused Silica Market is experiencing a notable surge in demand, particularly driven by the semiconductor sector. As technology advances, the need for high-purity fused silica, which is essential for photomasks and other semiconductor manufacturing processes, is increasing. In 2025, the semiconductor market is projected to reach approximately 600 billion USD, with fused silica playing a critical role in achieving the precision required for modern microelectronics. This trend suggests that the Fused Silica Market will continue to expand as manufacturers seek materials that can withstand the rigorous demands of semiconductor fabrication.

Advancements in Manufacturing Techniques

The Fused Silica Market is poised for growth due to advancements in manufacturing techniques. Innovations such as improved melting processes and enhanced purification methods are enabling the production of higher quality fused silica. These advancements not only increase yield but also reduce production costs, making fused silica more accessible to various industries. As manufacturing techniques continue to evolve, the Fused Silica Market is likely to see an influx of new applications and increased competition, further driving market expansion.

Emerging Applications in Renewable Energy

The Fused Silica Market is witnessing a rise in demand due to emerging applications in renewable energy technologies. Fused silica is increasingly used in solar panels and photovoltaic cells, where its properties enhance efficiency and durability. The renewable energy sector is expected to grow significantly, with investments projected to reach over 2 trillion USD by 2025. This growth indicates a promising future for the Fused Silica Market, as manufacturers seek materials that can improve the performance of renewable energy systems.