Expansion of Electric Vehicle Market

The GaN Epitaxial Wafer Market is poised to benefit from the rapid expansion of the electric vehicle (EV) market. As automakers increasingly focus on developing efficient powertrains, GaN technology is becoming a preferred choice due to its ability to enhance the efficiency of onboard chargers and power electronics. The GaN Epitaxial Wafer Market is projected to reach 30 million units by 2030, with GaN devices playing a crucial role in achieving the desired performance metrics. This trend suggests a promising outlook for the GaN Epitaxial Wafer Market, as the automotive sector continues to embrace advanced semiconductor technologies to meet stringent regulatory standards and consumer expectations.

Increased Investment in Renewable Energy

The GaN Epitaxial Wafer Market is likely to see growth driven by increased investment in renewable energy sources. As countries strive to meet sustainability goals, there is a growing emphasis on energy-efficient technologies, including those utilizing GaN-based devices. These devices are essential for optimizing power conversion in solar inverters and wind turbine systems, contributing to overall system efficiency. The renewable energy sector is expected to attract investments exceeding USD 2 trillion by 2025, creating a favorable environment for the adoption of GaN technology. This trend indicates a strong potential for the GaN Epitaxial Wafer Market as it aligns with global efforts to transition towards cleaner energy solutions.

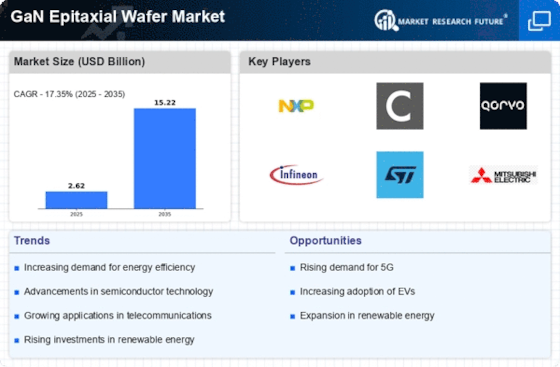

Rising Demand for High-Power Electronics

The GaN Epitaxial Wafer Market is experiencing a notable surge in demand for high-power electronics, driven by the increasing need for efficient power conversion in various applications. Industries such as automotive, aerospace, and renewable energy are increasingly adopting GaN technology due to its superior performance characteristics, including higher efficiency and reduced thermal management requirements. The market for power electronics is projected to reach USD 1 trillion by 2025, with GaN devices expected to capture a significant share due to their ability to operate at higher voltages and frequencies. This trend indicates a robust growth trajectory for the GaN Epitaxial Wafer Market, as manufacturers seek to meet the evolving demands of high-performance applications.

Advancements in RF and Microwave Technologies

The GaN Epitaxial Wafer Market is significantly influenced by advancements in RF and microwave technologies. The increasing demand for high-frequency applications, particularly in telecommunications and radar systems, has led to a growing preference for GaN-based devices. These devices offer superior performance in terms of power density and efficiency, making them ideal for next-generation communication systems. The RF GaN market is anticipated to grow at a CAGR of over 20% through 2025, reflecting the rising adoption of GaN technology in 5G infrastructure and satellite communications. This growth underscores the pivotal role of GaN epitaxial wafers in enhancing the performance of RF and microwave applications.

Emerging Applications in Consumer Electronics

The GaN Epitaxial Wafer Market is witnessing a rise in emerging applications within the consumer electronics sector. With the proliferation of smart devices and the Internet of Things (IoT), there is an increasing demand for compact and efficient power solutions. GaN technology offers advantages such as smaller form factors and higher efficiency, making it suitable for chargers, adapters, and other consumer electronics. The consumer electronics market is projected to grow at a CAGR of 5% through 2025, with GaN devices expected to capture a notable share due to their performance benefits. This trend highlights the evolving landscape of the GaN Epitaxial Wafer Market as it adapts to the needs of modern consumers.

.png)