Increasing Adoption of 5G Technology

The increasing adoption of 5G technology is driving the GaN on Si EPI wafers Market. As telecommunications companies expand their networks to accommodate higher data rates and lower latency, the demand for efficient power amplifiers and RF components rises. GaN on Si EPI wafers Market, known for their high efficiency and thermal performance, are becoming essential in the development of 5G infrastructure. The market for 5G-related components is projected to reach substantial figures, with estimates suggesting a growth rate of over 30% annually. This trend indicates a robust demand for GaN on Si EPI wafers Market, as they play a crucial role in enabling the performance required for next-generation wireless communication.

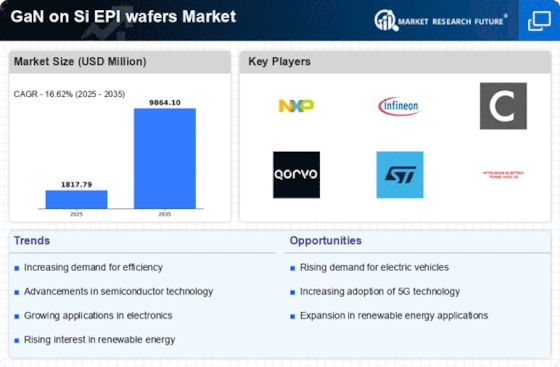

Surge in Electric Vehicle Production

The surge in electric vehicle (EV) production is significantly impacting the GaN on Si EPI wafers Market. As manufacturers strive to enhance the efficiency and performance of EV powertrains, GaN technology offers advantages such as reduced size and weight, along with improved energy conversion efficiency. The GaN on Si EPI wafers Market is expected to witness a compound annual growth rate (CAGR) of around 25% in the coming years. This growth translates into an increased demand for GaN on Si EPI wafers Market, which are integral to the development of advanced power electronics in EVs. Consequently, the GaN on Si EPI wafers Market is likely to benefit from this upward trend in the automotive sector.

Expansion of Consumer Electronics Market

The expansion of the consumer electronics market is a key driver for the GaN on Si EPI wafers Market. With the proliferation of smart devices, including smartphones, tablets, and wearables, there is a growing need for efficient power management solutions. GaN technology, with its ability to handle higher power densities and improve thermal performance, is increasingly being adopted in chargers and power supplies. The consumer electronics market is projected to grow at a CAGR of approximately 10% over the next few years, further fueling the demand for GaN on Si EPI wafers Market. This trend indicates a promising outlook for the GaN on Si EPI wafers Market as manufacturers seek to enhance device performance and energy efficiency.

Government Initiatives for Energy Efficiency

Government initiatives aimed at promoting energy efficiency are influencing the GaN on Si EPI wafers Market. Many countries are implementing regulations and incentives to encourage the adoption of energy-efficient technologies across various sectors. GaN on Si EPI wafers Market, known for their superior performance in power conversion applications, are well-positioned to meet these regulatory demands. The push for energy-efficient solutions in industrial and commercial applications is expected to drive the market for GaN on Si EPI wafers Market, as businesses seek to comply with energy standards. This regulatory environment suggests a favorable landscape for the GaN on Si EPI wafers Market, potentially leading to increased investments and innovations.

Technological Advancements in Power Electronics

Technological advancements in power electronics are propelling the GaN on Si EPI wafers Market forward. Innovations in semiconductor materials and fabrication techniques are enhancing the performance and reliability of GaN devices. As industries increasingly adopt advanced power electronics for applications such as renewable energy systems and electric vehicles, the demand for GaN on Si EPI wafers Market is likely to rise. The market for power electronics is anticipated to grow significantly, with projections indicating a CAGR of around 15% in the next few years. This growth reflects the increasing reliance on GaN technology to meet the performance requirements of modern electronic systems, thereby benefiting the GaN on Si EPI wafers Market.

.png)