Market Share

Gasoline Direct Injection Market Share Analysis

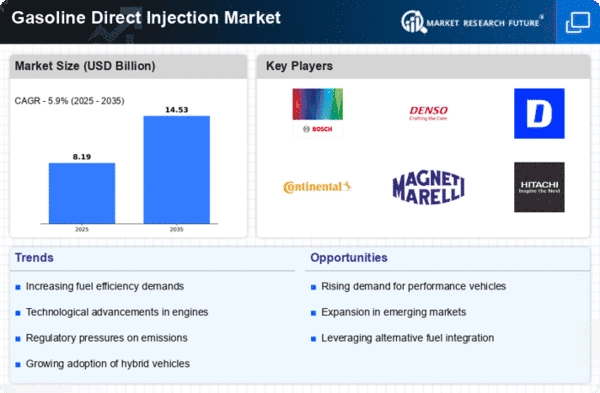

In the pretty competitive landscape of the Gasoline Direct Injection (GDI) marketplace, organizations appoint various market percentage positioning strategies to gain a aggressive facet and capture a larger percentage of the market. One normal approach is differentiation, in which companies cognizance on supplying particular features or technology that sets their GDI systems apart from competitors. This should involve improvements in gasoline performance, decreased emissions, or more desirable engine overall performance. By providing a awesome fee proposition, businesses intend to attract a gap phase of clients who prioritize particular blessings. Market segmentation is every other powerful approach, in which agencies tailor their GDI services to cater to unique marketplace segments. This includes knowledge the diverse desires and possibilities of purchasers and developing GDI structures that align with those requirements. For instance, some customers may also prioritize overall performance, at the same time as others might also prioritize fuel performance or environmental sustainability. By segmenting the marketplace and customizing products for this reason, businesses can address various client demands and set up a robust presence in diverse segments. Collaborative partnerships and alliances additionally play a pivotal role in marketplace share positioning inside the GDI industry. Companies may additionally form strategic partnerships with car manufacturers, gas providers, or generation builders to create included solutions that provide a complete package deal to clients. Such collaborations enable organizations to leverage complementary strengths, proportion assets, and penetrate new markets together. By joining forces, businesses can decorate their market presence and competitiveness inside the unexpectedly evolving automobile industry. Strategic advertising and branding tasks are vital components of market proportion positioning techniques. Effective communique of a brand's values, product benefits, and technological improvements enables the construction of client consideration and loyalty. Companies spend money on advertising and marketing campaigns that highlight the specific selling propositions of their GDI systems, growing a wonderful perception in the minds of purchasers. Building a robust emblem presence no longer only draws new customers however additionally keeps existing ones, contributing to sustained market proportion growth. Continuous innovation is a fundamental strategy in the dynamic GDI market. As car technologies evolve, businesses need to live at the vanguard of innovation to stay competitive. This involves making an investment in research and development to introduce modern-day capabilities, enhance performance, and meet emerging environmental requirements. By constantly handing over revolutionary solutions, businesses can function themselves as industry leaders, attracting customers who searching for the today's improvements in GDI era. In end, the Gasoline Direct Injection market is fiercely aggressive, and agencies rent a variety of techniques to position themselves favorably in terms of market share. Whether thru differentiation, value leadership, market segmentation, collaborations, strategic advertising and marketing, or non-stop innovation, a hit corporations apprehend the importance of adapting their technique to fulfill the evolving wishes of purchasers and the enterprise.

Leave a Comment