Advancements in Drug Development

Innovations in drug development are significantly influencing the asthma copd-drugs market. The emergence of novel therapeutic agents, including biologics and targeted therapies, is reshaping treatment paradigms. In the GCC, pharmaceutical companies are increasingly investing in research and development, with expenditures reaching approximately $1.5 billion in recent years. This focus on innovation is likely to yield new drugs that offer improved efficacy and safety profiles, addressing unmet medical needs. Additionally, the integration of advanced technologies, such as artificial intelligence in drug discovery, may expedite the development process, leading to a more robust pipeline of asthma copd-drugs. As a result, the market is poised for substantial growth driven by these advancements.

Increased Awareness and Education

Raising awareness about asthma and COPD is crucial for the growth of the asthma copd-drugs market. Public health campaigns in the GCC are focusing on educating patients and healthcare providers about the importance of early diagnosis and effective management of respiratory diseases. This heightened awareness is likely to lead to increased patient engagement and adherence to treatment regimens. Moreover, educational initiatives are expected to improve the understanding of available therapies, thereby driving demand for asthma copd-drugs. As more individuals seek medical advice and treatment options, the market is anticipated to expand, reflecting the positive impact of education on health outcomes.

Growing Demand for Personalized Medicine

The trend towards personalized medicine is emerging as a key driver in the asthma copd-drugs market. Tailoring treatments to individual patient profiles, including genetic and phenotypic characteristics, is gaining traction in the GCC. This approach is expected to enhance treatment efficacy and minimize adverse effects, thereby improving patient outcomes. As healthcare providers increasingly adopt personalized treatment strategies, the demand for specific asthma copd-drugs that cater to diverse patient needs is likely to rise. Furthermore, advancements in diagnostic technologies are facilitating the identification of suitable candidates for targeted therapies, potentially transforming the landscape of asthma and COPD management in the region.

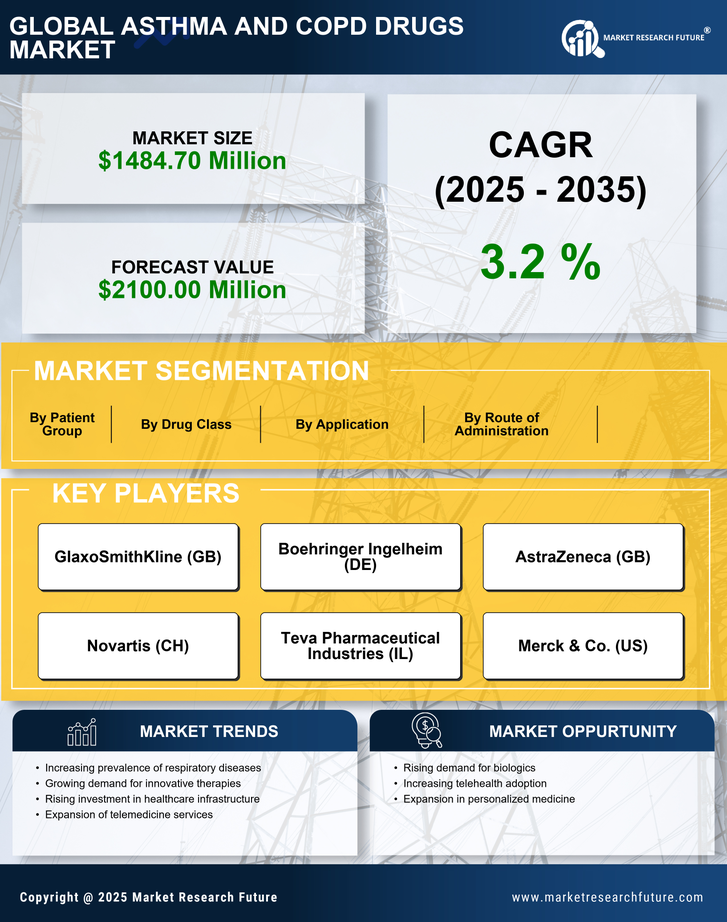

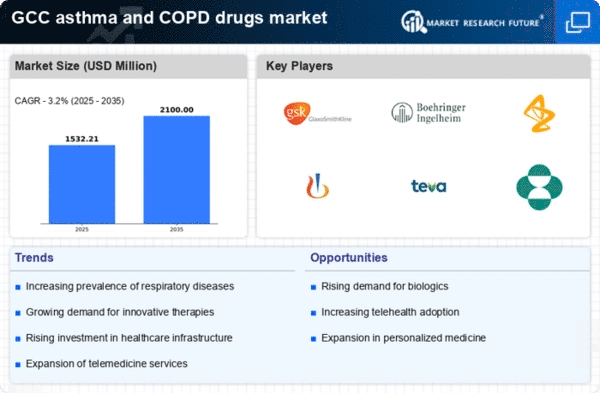

Rising Prevalence of Respiratory Diseases

The increasing incidence of respiratory diseases, particularly asthma and COPD, is a primary driver for the asthma copd-drugs market. In the GCC region, the prevalence of asthma is estimated to be around 10-15% among adults, while COPD affects approximately 4-6% of the population. This growing burden of disease necessitates effective treatment options, thereby propelling the demand for asthma copd-drugs. Furthermore, the aging population in the GCC, which is projected to rise significantly, is likely to contribute to higher rates of respiratory conditions. As healthcare systems adapt to these challenges, investments in innovative therapies and medications are expected to increase, further stimulating market growth.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving healthcare infrastructure and access to medications are pivotal for the asthma copd-drugs market. In the GCC, various countries are implementing policies to enhance the availability of essential drugs and promote affordable healthcare. For instance, initiatives to subsidize asthma copd-drugs can significantly reduce the financial burden on patients, encouraging adherence to prescribed therapies. Additionally, regulatory frameworks are evolving to facilitate faster approvals for new treatments, which may further stimulate market growth. As governments prioritize respiratory health, the asthma copd-drugs market is likely to benefit from supportive policies and increased funding for healthcare services.