Emergence of IoT Technologies

The emergence of Internet of Things (IoT) technologies is reshaping the landscape of the big data-software market in the GCC. With the proliferation of connected devices, organizations are collecting unprecedented volumes of data that necessitate advanced analytics and processing capabilities. This trend is particularly relevant in sectors such as healthcare, manufacturing, and transportation, where real-time data insights can lead to improved operational efficiencies. As IoT adoption continues to rise, the big data-software market is likely to evolve, offering solutions that can effectively manage and analyze the influx of data generated by these devices.

Rising Demand for Data Analytics

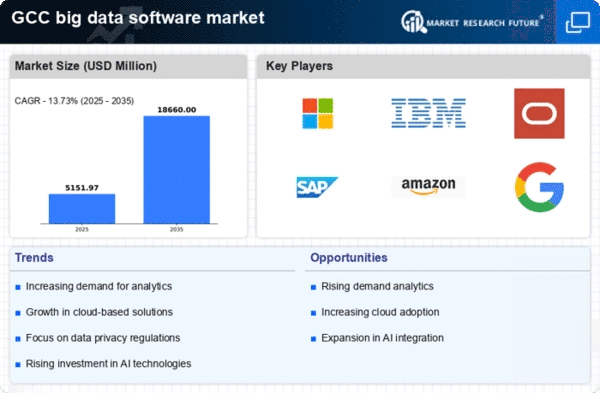

The big data-software market is experiencing a notable surge in demand for data analytics solutions across various sectors in the GCC. Organizations are increasingly recognizing the value of data-driven decision-making, which is leading to a heightened investment in analytics tools. According to recent estimates, the market for data analytics in the region is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for businesses to enhance operational efficiency and gain competitive advantages. As companies strive to harness insights from vast datasets, the big data-software market is likely to expand, providing innovative solutions that cater to diverse analytical needs.

Government Initiatives and Support

Government initiatives in the GCC are playing a pivotal role in shaping the big data-software market. Various national strategies emphasize the importance of digital transformation and data utilization for economic growth. For instance, initiatives aimed at fostering smart cities and enhancing public services are driving investments in big data technologies. The region's governments are allocating substantial budgets to support research and development in data analytics, which is expected to bolster the market. As a result, the big data-software market is likely to benefit from increased funding and resources, facilitating the development of advanced solutions tailored to local needs.

Focus on Enhanced Customer Experience

In the competitive landscape of the GCC, businesses are increasingly prioritizing enhanced customer experience, which is driving the demand for big data solutions. Organizations are leveraging data analytics to gain insights into customer preferences and behaviors, enabling them to tailor their offerings accordingly. This focus on customer-centric strategies is prompting investments in big data-software that can provide actionable insights. As companies strive to differentiate themselves in a crowded market, the big data-software market is expected to grow, offering tools that facilitate personalized marketing and improved customer engagement.

Growth of E-commerce and Digital Services

The rapid expansion of e-commerce and digital services in the GCC is significantly influencing the big data-software market. As online transactions and digital interactions increase, businesses are generating vast amounts of data that require sophisticated analysis. This trend is prompting companies to invest in big data solutions to better understand consumer behavior and optimize their offerings. Recent reports indicate that the e-commerce sector in the GCC is expected to reach a valuation of $28 billion by 2026, further driving the demand for data management and analytics tools. Consequently, the big data-software market is poised for growth as organizations seek to leverage data for strategic advantages.