Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in the GCC are significantly influencing the cardiovascular information-system market. Various national health strategies emphasize the importance of digital health solutions, leading to increased funding for healthcare technology. For instance, the Saudi Vision 2030 plan includes substantial investments in health technology, which is expected to enhance the adoption of cardiovascular information systems. Additionally, the UAE's health authorities are actively promoting the integration of digital health solutions to improve patient outcomes. Such governmental support not only boosts market growth but also encourages private sector investments, creating a conducive environment for innovation in the cardiovascular information-system market.

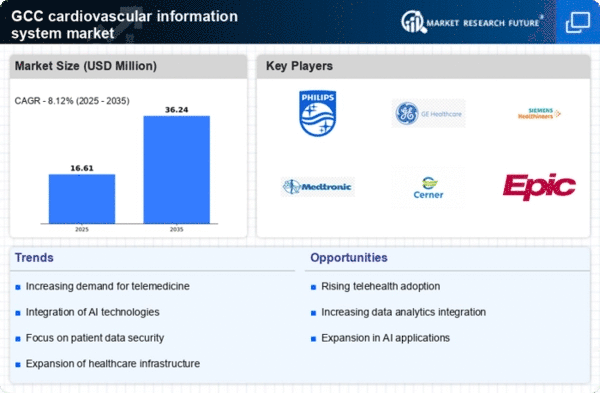

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into healthcare systems is transforming the cardiovascular information-system market. AI technologies enable healthcare providers to analyze vast amounts of patient data, leading to more accurate diagnoses and personalized treatment plans. In the GCC, the adoption of AI-driven solutions is gaining momentum, with projections suggesting that the market for AI in healthcare could reach $2.5 billion by 2027. This technological advancement allows for predictive analytics, which can identify potential cardiovascular issues before they escalate, thereby improving patient outcomes. As healthcare providers increasingly recognize the benefits of AI, the cardiovascular information-system market is poised for significant expansion.

Emphasis on Data Security and Compliance

As the cardiovascular information-system market expands, the emphasis on data security and compliance with regulations is becoming increasingly critical. Healthcare providers in the GCC are under pressure to protect sensitive patient information while adhering to stringent data protection laws. The implementation of robust cybersecurity measures is essential to safeguard against data breaches, which can have severe repercussions for both patients and healthcare institutions. Furthermore, compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) is vital for maintaining trust and credibility. Consequently, investments in secure cardiovascular information systems are likely to rise, driving market growth as organizations prioritize data integrity and patient confidentiality.

Rising Cardiovascular Disease Prevalence

The increasing prevalence of cardiovascular diseases in the GCC region is a primary driver for the cardiovascular information-system market. As lifestyle-related health issues become more common, healthcare providers are compelled to adopt advanced information systems to manage patient data effectively. Reports indicate that cardiovascular diseases account for approximately 40% of all deaths in the GCC, necessitating improved monitoring and management solutions. This alarming statistic underscores the urgent need for healthcare facilities to invest in sophisticated information systems that can streamline patient care and enhance treatment outcomes. Consequently, the cardiovascular information-system market is likely to experience substantial growth as healthcare providers seek to address this pressing public health challenge.

Growing Demand for Remote Patient Monitoring

The demand for remote patient monitoring solutions is on the rise in the GCC, driven by the need for continuous care for patients with cardiovascular conditions. As healthcare systems strive to enhance patient engagement and reduce hospital readmissions, cardiovascular information systems that facilitate remote monitoring are becoming essential. This trend is particularly relevant in the context of an aging population, where chronic diseases are prevalent. Market analysis indicates that the remote patient monitoring segment is expected to grow at a CAGR of 25% over the next five years. This growth reflects the increasing reliance on technology to manage cardiovascular health, thereby propelling the cardiovascular information-system market forward.