Enhanced Security Features

Security concerns are paramount in the financial sector, and the contactless smart-card market is responding with enhanced security features. Innovations such as EMV (Europay, MasterCard, and Visa) technology and biometric authentication are becoming standard in the GCC. These advancements not only protect against fraud but also instill consumer confidence in contactless transactions. The market is witnessing a shift towards cards equipped with advanced encryption and tokenization methods, which are expected to reduce fraud rates significantly. As security becomes a focal point for consumers and businesses alike, the demand for secure contactless smart cards is anticipated to rise, thereby propelling the market forward.

Rising E-commerce Activities

The surge in e-commerce activities in the GCC region is significantly impacting the contactless smart-card market. As online shopping becomes more prevalent, consumers are seeking secure and efficient payment methods. Contactless smart cards offer a seamless experience for online transactions, which is appealing to both consumers and merchants. Recent statistics indicate that e-commerce sales in the GCC are expected to exceed $30 billion by 2026, with a substantial portion of these transactions being conducted via contactless methods. This trend suggests that the contactless smart-card market will likely expand as more businesses integrate these payment solutions to cater to the evolving preferences of online shoppers.

Government Support and Regulation

Government initiatives and regulatory frameworks play a crucial role in shaping the contactless smart-card market. In the GCC, authorities are actively promoting digital payment solutions to enhance financial inclusion and streamline transactions. For instance, the Central Bank of the UAE has introduced regulations that encourage the adoption of contactless payment technologies. Such supportive measures are likely to foster a conducive environment for market growth. Furthermore, as governments push for cashless economies, the contactless smart-card market is expected to benefit from increased investments in infrastructure and technology, paving the way for broader adoption across various sectors.

Growing Demand for Contactless Payments

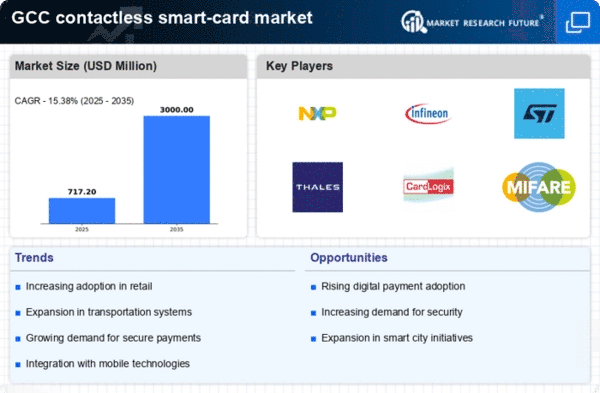

The rising demand for contactless payments is a primary driver for the contactless smart-card market. Consumers in the GCC region increasingly prefer the convenience and speed of contactless transactions, which are perceived as safer and more efficient. According to recent data, the value of contactless transactions in the GCC is projected to reach $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of approximately 20%. This trend is further fueled by the increasing penetration of smartphones and digital wallets, which facilitate contactless payments. As more retailers and service providers adopt this technology, the contactless smart-card market is likely to experience substantial growth, driven by consumer preferences for seamless payment experiences.

Technological Integration in Transportation

The integration of contactless smart cards in transportation systems is a significant driver for the market. Many GCC cities are adopting smart card solutions for public transport, allowing passengers to pay for fares quickly and efficiently. This integration not only enhances the user experience but also streamlines operations for transport authorities. For example, the introduction of contactless payment systems in metro and bus services has led to increased ridership and improved revenue collection. As urbanization continues and public transport systems evolve, the contactless smart-card market is poised for growth, driven by the need for efficient and user-friendly payment solutions in transportation.