Rising Health Awareness

The covid 19-diagnostics market is experiencing a notable surge in demand due to increasing health awareness among the population in the GCC. As individuals become more conscious of their health and the importance of early detection, the need for reliable diagnostic tests has escalated. This trend is further supported by government initiatives promoting health education and preventive measures. In 2025, the market is projected to grow by approximately 15%, driven by a heightened focus on personal health management. The covid 19-diagnostics market is thus positioned to benefit from this shift in consumer behavior, as more individuals seek out testing options to ensure their well-being.

Emergence of New Variants

The continuous emergence of new covid variants is a critical driver for the covid 19-diagnostics market. As variants evolve, the demand for accurate and rapid testing solutions becomes increasingly vital. In the GCC, health authorities are emphasizing the need for updated diagnostic tests that can effectively identify these variants. This has led to a projected increase in the market size by 10% in 2025, as healthcare providers seek to implement more robust testing protocols. The covid 19-diagnostics market must adapt to these challenges by investing in research and development to ensure that testing remains effective against emerging strains.

Government Initiatives and Funding

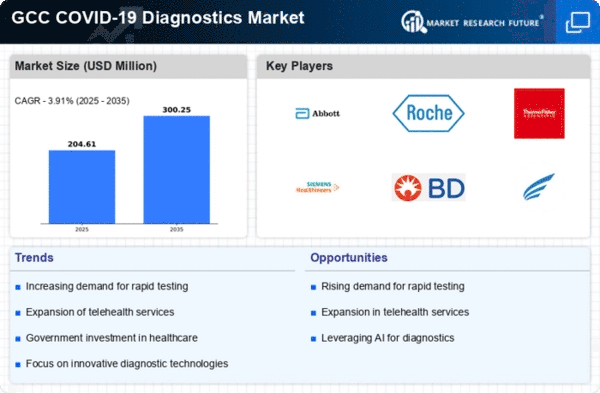

Government initiatives aimed at enhancing public health infrastructure are significantly impacting the covid 19-diagnostics market. In the GCC, substantial funding has been allocated to improve healthcare facilities and expand testing capabilities. For instance, recent reports indicate that investments in diagnostic technologies have increased by 20% in the past year. This financial support not only facilitates the development of advanced testing methods but also ensures that diagnostic services are accessible to a broader population. Consequently, the covid 19-diagnostics market is likely to see sustained growth as governments prioritize health security and invest in innovative solutions.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the covid 19-diagnostics market. Innovations such as artificial intelligence and machine learning are enhancing the accuracy and efficiency of diagnostic tests. In the GCC, healthcare facilities are increasingly adopting these technologies, leading to a projected market growth of 12% by the end of 2025. This technological evolution not only streamlines testing processes but also improves patient outcomes by enabling quicker diagnosis and treatment. The covid 19-diagnostics market is thus poised to leverage these advancements to meet the growing demand for reliable testing solutions.

Increased Collaboration Among Stakeholders

Collaboration among various stakeholders, including governments, healthcare providers, and private companies, is fostering growth in the covid 19-diagnostics market. In the GCC, partnerships are being formed to enhance testing capabilities and share resources. This collaborative approach has resulted in a 15% increase in the availability of diagnostic tests over the past year. By pooling expertise and resources, stakeholders are better equipped to address public health challenges. The covid 19-diagnostics market stands to benefit from this synergy, as it leads to more comprehensive testing strategies and improved health outcomes for the population.