Growing Geriatric Population

The increasing geriatric population in the GCC is a significant driver for the dental radiology-imaging-devices market. As the elderly population grows, there is a corresponding rise in dental health issues that require advanced diagnostic imaging. Older adults often face complex dental conditions that necessitate precise imaging for effective treatment planning. This demographic shift is expected to lead to a heightened demand for dental radiology-imaging devices, as practitioners seek to provide tailored care for this age group. The market is anticipated to expand, with estimates suggesting that the geriatric segment could account for over 30% of dental visits by 2030. Consequently, the dental radiology-imaging-devices market is likely to see substantial growth driven by the needs of an aging population.

Rising Oral Health Awareness

The increasing awareness of oral health among the population in the GCC is driving the dental radiology-imaging-devices market. As individuals become more informed about the importance of dental care, the demand for diagnostic imaging technologies rises. This trend is reflected in the growing number of dental clinics and practices adopting advanced imaging solutions. The market is projected to witness a growth rate of approximately 8% annually, as more practitioners recognize the value of early detection and preventive care facilitated by these devices. Enhanced patient education initiatives and community health programs further contribute to this awareness, leading to a higher utilization of dental radiology-imaging devices. Consequently, the dental radiology-imaging-devices market is likely to expand as patients seek comprehensive dental services that include advanced imaging techniques.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in the GCC are positively impacting the dental radiology-imaging-devices market. Increased funding for healthcare facilities and dental practices encourages the adoption of advanced imaging technologies. Various governments in the region are investing in modernizing healthcare services, which includes upgrading dental imaging equipment. This support is crucial as it enables dental practitioners to offer high-quality services, thereby attracting more patients. The dental radiology-imaging-devices market is likely to benefit from these initiatives, with projections indicating a compound annual growth rate (CAGR) of around 7% over the next five years. Such government backing not only enhances the accessibility of dental care but also promotes the integration of innovative imaging solutions.

Increased Investment in Dental Research

The surge in investment in dental research and development within the GCC is fostering advancements in the dental radiology-imaging-devices market. Research institutions and private companies are focusing on developing innovative imaging technologies that enhance diagnostic capabilities. This investment is crucial for the evolution of imaging devices, leading to improved accuracy and efficiency in dental diagnostics. The market is projected to experience a growth trajectory, with funding for dental research expected to reach approximately $200 million by 2026. As new technologies emerge from this research, dental practitioners are likely to adopt these innovations, further driving the demand for advanced imaging solutions. This trend indicates a robust future for the dental radiology-imaging-devices market as it aligns with ongoing advancements in dental care.

Technological Integration in Dental Practices

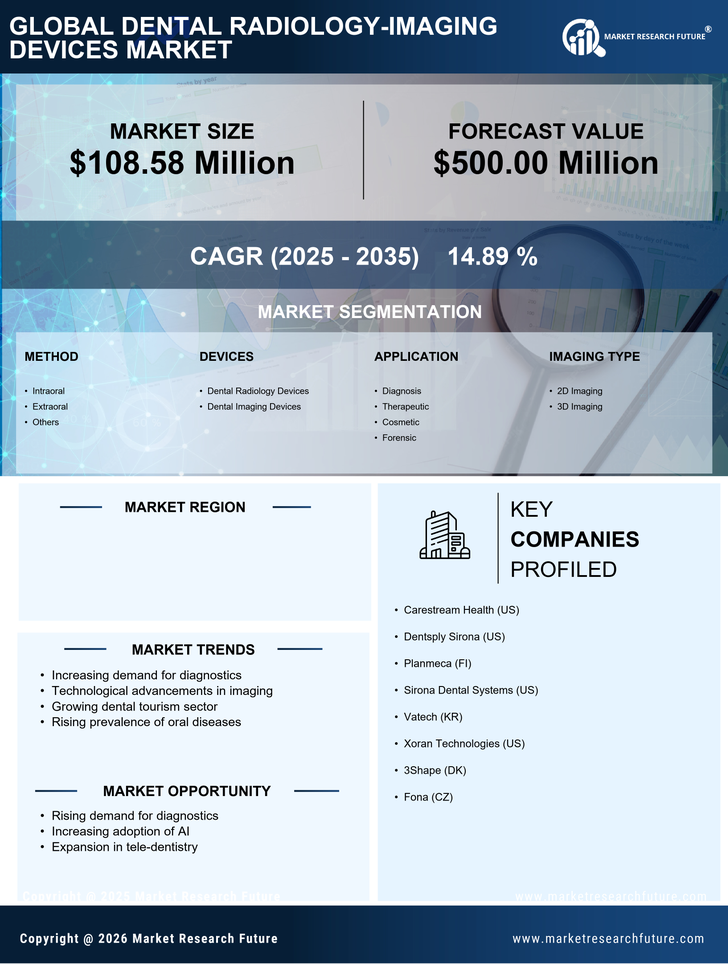

The integration of advanced technologies in dental practices is a key driver for the dental radiology-imaging-devices market. Innovations such as digital radiography, 3D imaging, and cone beam computed tomography (CBCT) are becoming increasingly prevalent in the GCC region. These technologies not only enhance diagnostic accuracy but also improve patient experience by reducing radiation exposure and providing immediate results. The market for dental imaging devices is expected to grow significantly, with estimates suggesting a valuation of over $500 million by 2027. As dental professionals adopt these technologies, the demand for sophisticated imaging devices is likely to increase, thereby propelling the growth of the dental radiology-imaging-devices market. This trend indicates a shift towards more efficient and effective dental care solutions.