Rising Prevalence of Diabetes

The increasing prevalence of diabetes in the GCC region is a primary driver for the digital diabetes-management market. According to health statistics, the GCC countries have witnessed a surge in diabetes cases, with estimates suggesting that around 20% of the adult population is affected. This alarming trend necessitates innovative management solutions, leading to a growing demand for digital tools that facilitate monitoring and treatment. The digital diabetes-management market is expected to expand as healthcare providers and patients seek effective ways to manage this chronic condition. The integration of technology in diabetes care not only enhances patient outcomes but also reduces the burden on healthcare systems, making it a crucial factor in the market's growth.

Government Initiatives and Support

Government initiatives aimed at combating diabetes in the GCC region significantly influence the digital diabetes-management market. Various health ministries have launched campaigns to promote awareness and prevention of diabetes, which often include the adoption of digital health solutions. For instance, funding and support for digital health startups have increased, with governments recognizing the potential of technology in improving healthcare delivery. This support is likely to foster innovation and encourage the development of new digital tools tailored for diabetes management. As a result, the digital diabetes-management market is poised for growth, driven by favorable policies and investments in health technology.

Increased Health Awareness and Education

The rising health awareness and education among the population in the GCC region are driving the digital diabetes-management market. As individuals become more informed about diabetes and its complications, there is a growing demand for tools that assist in effective management. Educational programs and resources that promote understanding of diabetes management are increasingly available, leading to a more proactive approach among patients. This heightened awareness encourages the adoption of digital solutions that facilitate self-management and monitoring. Consequently, the digital diabetes-management market is likely to experience growth as patients seek out technologies that empower them to take control of their health.

Technological Advancements in Health Monitoring

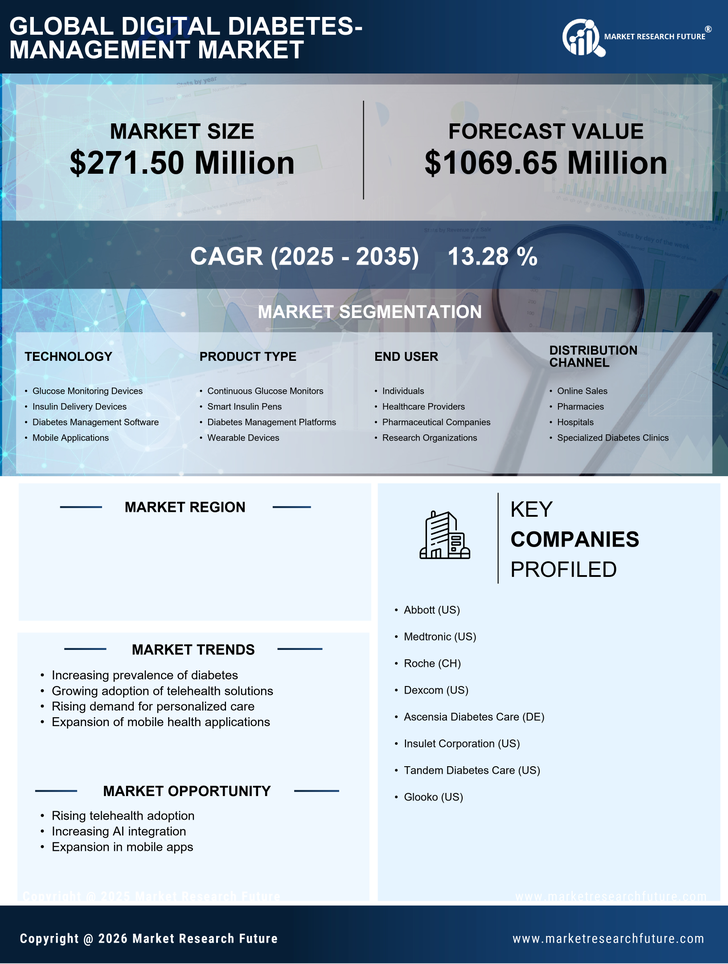

Technological advancements in health monitoring devices are transforming the digital diabetes-management market. Innovations such as continuous glucose monitoring (CGM) systems and mobile health applications are becoming increasingly sophisticated, allowing for real-time data collection and analysis. These technologies enable patients to track their glucose levels more effectively and make informed decisions regarding their health. The market for digital diabetes-management is likely to benefit from these advancements, as they enhance user experience and improve adherence to treatment plans. Furthermore, the integration of wearable devices with mobile applications is expected to create a more comprehensive approach to diabetes management, appealing to both patients and healthcare providers.

Growing Demand for Personalized Healthcare Solutions

The shift towards personalized healthcare solutions is a notable driver of the digital diabetes-management market. Patients are increasingly seeking tailored approaches to their health, which includes customized treatment plans and monitoring tools. This trend is particularly evident in the GCC region, where cultural and lifestyle factors influence diabetes management. Digital platforms that offer personalized insights and recommendations based on individual health data are gaining traction. As healthcare providers recognize the importance of personalized care, the digital diabetes-management market is likely to expand, offering solutions that cater to the unique needs of patients. This focus on personalization may enhance patient engagement and improve health outcomes.