Government Initiatives and Support

Government initiatives in the GCC are playing a crucial role in shaping the enterprise asset-management market. Various national strategies aim to enhance infrastructure and promote technological adoption across industries. For instance, the UAE's Vision 2021 emphasizes the importance of innovation and efficiency in asset management. Such initiatives are likely to encourage public and private sector collaboration, leading to increased investments in enterprise asset-management solutions. As governments continue to support modernization efforts, the market is expected to witness substantial growth, driven by enhanced regulatory frameworks and funding opportunities.

Focus on Risk Management and Safety

The enterprise asset-management market in the GCC is significantly influenced by the heightened focus on risk management and safety protocols. Organizations are increasingly recognizing the importance of maintaining asset integrity to mitigate risks associated with asset failure. This trend is particularly relevant in sectors such as oil and gas, where the cost of asset failure can be substantial. As a result, companies are investing in enterprise asset-management solutions that enhance safety measures and compliance with industry standards. This focus on risk management is expected to drive growth in the market, as organizations seek to protect their assets and ensure operational continuity.

Rising Demand for Operational Efficiency

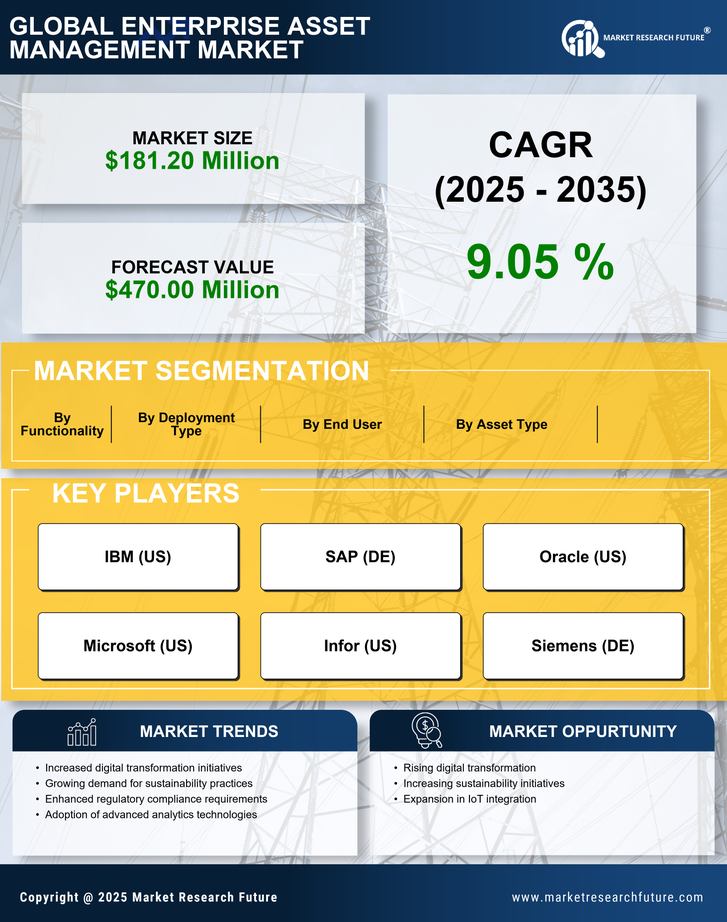

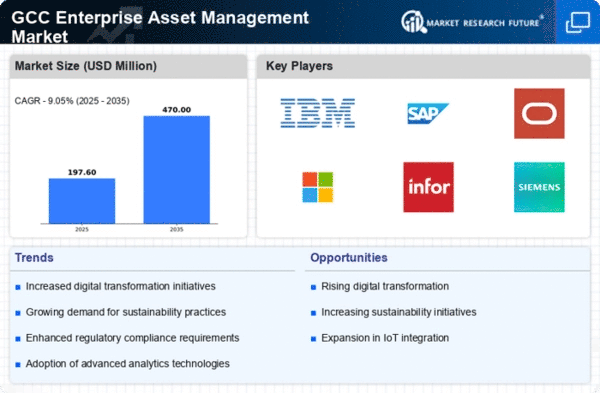

In the GCC, the enterprise asset-management market is driven by a growing emphasis on operational efficiency. Organizations are under pressure to optimize their asset performance while minimizing costs. This demand is reflected in the increasing investments in asset management software, which are projected to reach $1.5 billion by 2026. Companies are seeking solutions that streamline processes, reduce downtime, and enhance productivity. As a result, the enterprise asset-management market is likely to expand, with businesses prioritizing systems that provide comprehensive visibility and control over their assets.

Technological Advancements in Asset Management

The enterprise asset-management market is experiencing a surge in technological advancements, particularly in the GCC region. Innovations such as IoT, AI, and machine learning are transforming how organizations manage their assets. These technologies enable real-time monitoring and predictive maintenance, which can lead to a reduction in operational costs by up to 30%. Furthermore, the integration of advanced analytics allows for better decision-making, enhancing asset utilization and lifespan. As organizations increasingly adopt these technologies, the demand for sophisticated enterprise asset-management solutions is likely to grow, indicating a robust market trajectory in the GCC.

Growing Importance of Data-Driven Decision Making

The enterprise asset-management market is increasingly influenced by the growing importance of data-driven decision making in the GCC. Organizations are recognizing that leveraging data analytics can significantly enhance asset performance and operational efficiency. By utilizing data from various sources, companies can make informed decisions regarding maintenance schedules, asset replacements, and resource allocation. This trend is likely to propel the demand for advanced enterprise asset-management solutions that offer robust data analytics capabilities. As businesses strive to harness the power of data, the market is expected to expand, reflecting a shift towards more strategic asset management practices.