Emergence of 5G Technology

The fog computing market is expected to grow significantly with the emergence of 5G technology in the GCC. The rollout of 5G networks is expected to enhance connectivity and enable faster data transmission, which is essential for fog computing applications. This technology allows for the deployment of more sophisticated IoT solutions that require low latency and high bandwidth. As 5G becomes more prevalent, the fog computing market is likely to expand, providing the necessary infrastructure to support the increased data flow. Industry expert's suggest that the integration of 5G with fog computing could lead to a market growth rate of around 30% in the coming years, highlighting the synergy between these technologies.

Expansion of Smart City Initiatives

The fog computing market is significantly influenced by the expansion of smart city initiatives across the GCC. Governments are investing heavily in infrastructure that supports smart technologies, which require efficient data management and processing. Fog computing serves as a vital component in these initiatives, facilitating the integration of IoT devices and ensuring seamless communication between them. The market is expected to benefit from the projected investment of over $100 billion in smart city projects in the GCC by 2030. This investment underscores the importance of fog computing in managing the vast amounts of data generated by urban environments, thereby enhancing city services and quality of life.

Growth in Edge Computing Applications

The fog computing market is growing as organizations increasingly adopt edge computing applications. As organizations in the GCC strive to optimize their operations, they are turning to edge computing to process data closer to its source. This shift is particularly relevant in industries such as oil and gas, where real-time monitoring and analytics are crucial. The fog computing market is expected to capture a significant share of this trend, as it complements edge computing by providing additional layers of processing and storage. Analysts predict that the market could reach a valuation of $2 billion by 2026, driven by the demand for efficient data handling in edge environments.

Increased Focus on Data Privacy Regulations

The fog computing market is also being shaped by the increased focus on data privacy regulations in the GCC. As governments implement stricter data protection laws, organizations are compelled to adopt solutions that ensure compliance while managing data effectively. Fog computing offers a decentralized approach to data processing, which can enhance security and privacy by keeping sensitive information closer to its source. This trend is particularly relevant in sectors such as finance and healthcare, where data integrity is paramount. The market is likely to see a rise in demand for fog computing solutions that align with regulatory requirements, potentially driving growth by 20% over the next few years.

Rising Demand for Real-Time Data Processing

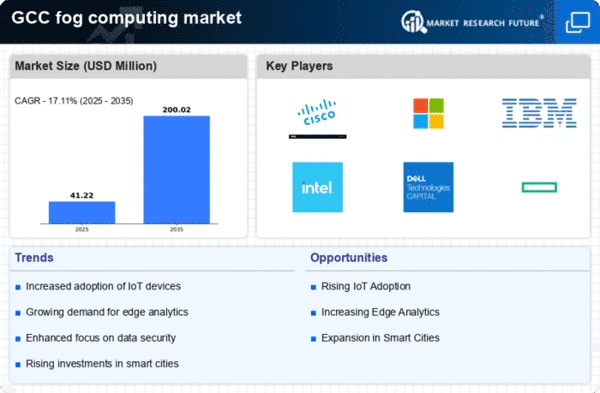

The fog computing market is experiencing a notable surge in demand for real-time data processing capabilities. This trend is largely driven by the increasing need for immediate insights in various sectors, including healthcare, manufacturing, and smart cities. In the GCC region, organizations are seeking to enhance operational efficiency and decision-making processes through timely data analysis. The fog computing market is positioned to address these needs by enabling data processing closer to the source, thereby reducing latency. As a result, the market is projected to grow at a CAGR of approximately 25% over the next five years, reflecting the critical role of real-time data in driving business success.