Aging Population

The demographic shift towards an aging population in the GCC is significantly influencing the general surgical-devices market. As the population aged 65 and above is projected to increase by 30% by 2030, the demand for surgical interventions is likely to rise correspondingly. Older adults typically require more surgical procedures due to age-related health issues, which drives the need for advanced surgical devices. This demographic trend suggests that healthcare providers will need to invest in modern surgical technologies to cater to the growing patient base. Consequently, the general surgical-devices market is poised for expansion, as healthcare systems adapt to meet the needs of an aging population.

Growing Medical Tourism

The GCC region is emerging as a hub for medical tourism, which is positively impacting the general surgical-devices market. With its advanced healthcare facilities and skilled medical professionals, the region attracts a significant number of international patients seeking surgical procedures. The medical tourism market in the GCC is projected to reach $10 billion by 2025, driven by the availability of high-quality surgical services at competitive prices. This influx of patients is likely to stimulate demand for advanced surgical devices, as healthcare providers strive to maintain high standards of care. Consequently, the general surgical-devices market is expected to benefit from this trend, as hospitals invest in state-of-the-art equipment to cater to the needs of medical tourists.

Rising Healthcare Expenditure

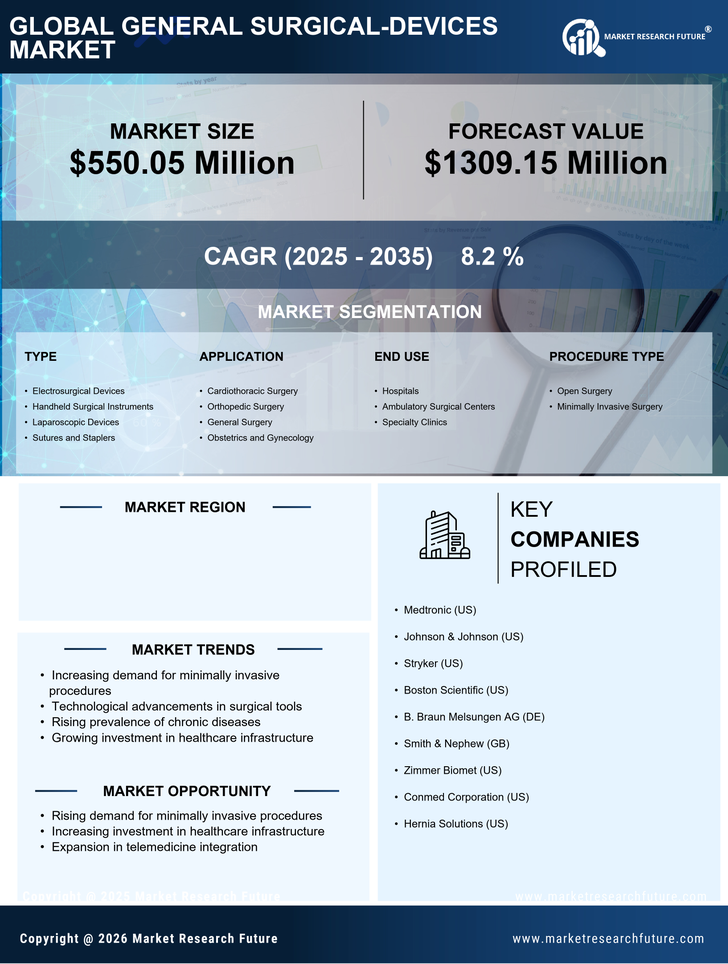

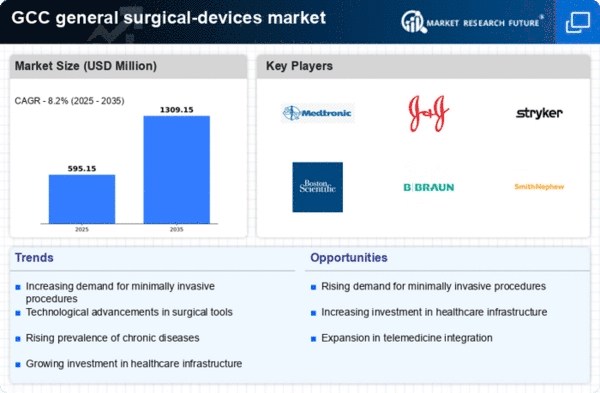

The increasing healthcare expenditure in the GCC region is a pivotal driver for the general surgical-devices market. Governments and private sectors are investing heavily in healthcare infrastructure, which is projected to reach approximately $100 billion by 2025. This surge in funding is likely to enhance the availability of advanced surgical devices, thereby improving patient outcomes. Furthermore, the growing demand for quality healthcare services is pushing hospitals to upgrade their surgical equipment. As a result, the general surgical-devices market is expected to witness substantial growth, with an anticipated CAGR of around 8% over the next few years. This trend indicates a robust market environment, fostering innovation and the introduction of new surgical technologies.

Technological Integration in Healthcare

The integration of technology in healthcare is transforming the general surgical-devices market. Innovations such as robotic-assisted surgeries, telemedicine, and artificial intelligence are enhancing surgical procedures and patient care. The GCC region is witnessing a rapid adoption of these technologies, with investments in digital health solutions projected to exceed $2 billion by 2025. This technological advancement is likely to improve surgical outcomes and reduce recovery times, thereby increasing the demand for sophisticated surgical devices. As healthcare providers embrace these innovations, the general surgical-devices market is expected to experience significant growth, driven by the need for modern solutions that enhance surgical efficiency and effectiveness.

Increased Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in the GCC region is a critical driver for the general surgical-devices market. Conditions such as diabetes, cardiovascular diseases, and obesity are becoming increasingly common, necessitating surgical interventions. For instance, the World Health Organization indicates that the incidence of diabetes in the GCC is expected to rise by 20% by 2030. This trend is likely to lead to a higher demand for surgical devices that can assist in managing these chronic conditions. As healthcare providers seek to improve treatment outcomes, the general surgical-devices market is expected to grow, driven by the need for innovative solutions to address these health challenges.