Rising Healthcare Costs

The health insurance market is currently influenced by the escalating costs associated with healthcare services. In the GCC, healthcare expenditure has been on an upward trajectory, with estimates suggesting a growth rate of approximately 10% annually. This increase in costs compels individuals and families to seek comprehensive health insurance coverage to mitigate financial risks. As a result, insurers are adapting their offerings to provide more tailored plans that address the specific needs of consumers. The rising healthcare costs are likely to drive demand for health insurance products, as individuals recognize the necessity of financial protection against unforeseen medical expenses. Consequently, the health insurance market is expected to expand as more people opt for coverage to safeguard their financial well-being.

Increased Health Awareness

There is a notable shift in public perception regarding health and wellness in the GCC, which is significantly impacting the health insurance market. As individuals become more health-conscious, they are increasingly seeking insurance plans that offer preventive care and wellness benefits. This trend is reflected in a growing demand for policies that cover routine check-ups, screenings, and vaccinations. The health insurance market is responding by incorporating wellness programs into their offerings, which not only attract new customers but also encourage existing policyholders to engage in healthier lifestyles. This heightened awareness of health issues is likely to contribute to a more robust health insurance market, as consumers prioritize their health and seek coverage that aligns with their wellness goals.

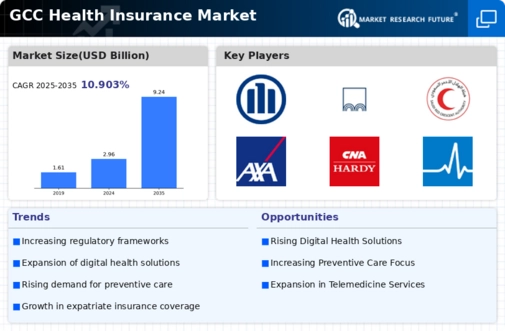

Government Initiatives and Policies

Government initiatives play a crucial role in shaping the health insurance market. In the GCC, various governments are implementing policies aimed at enhancing healthcare access and affordability. For instance, mandatory health insurance laws have been introduced in several countries, requiring employers to provide coverage for their employees. This regulatory framework is expected to increase the number of insured individuals, thereby expanding the health insurance market. Additionally, government subsidies and incentives for low-income families are likely to further stimulate demand for health insurance products. As these initiatives take effect, the health insurance market is poised for growth, driven by increased participation and a broader customer base.

Demographic Changes and Urbanization

Demographic shifts and urbanization are significant factors influencing the health insurance market. The GCC is experiencing rapid urban growth, leading to changes in lifestyle and health needs. An increasing population, particularly among younger demographics, is driving demand for health insurance products that cater to diverse needs. Urbanization often correlates with a rise in chronic diseases, prompting individuals to seek insurance coverage that addresses these health challenges. Additionally, as more people migrate to urban areas for employment opportunities, the demand for comprehensive health insurance is likely to increase. This demographic evolution presents both challenges and opportunities for the health insurance market, as insurers must adapt their offerings to meet the changing needs of a dynamic population.

Technological Advancements in Healthcare

The integration of technology into healthcare is transforming the health insurance market in the GCC. Innovations such as telemedicine, health apps, and electronic health records are enhancing the efficiency and accessibility of healthcare services. Insurers are leveraging these technologies to streamline claims processing and improve customer service. Moreover, the use of data analytics allows insurers to better understand consumer behavior and tailor their products accordingly. As technology continues to evolve, it is likely to create new opportunities for the health insurance market, enabling insurers to offer more personalized and efficient services. This technological shift may also lead to cost reductions, making health insurance more attractive to a wider audience.