Expansion of Distribution Channels

The homeopathic medicine market is witnessing an expansion of distribution channels, which is crucial for its growth in the GCC. Traditional pharmacies are increasingly stocking homeopathic products, while online platforms are also gaining traction. This diversification in distribution allows for greater accessibility of homeopathic remedies to consumers. Recent data suggests that online sales of homeopathic products have surged by 30% in the last year, reflecting a shift in consumer purchasing behavior. The convenience of e-commerce, coupled with the rise of health-focused online retailers, is likely to enhance the visibility and availability of homeopathic options, thereby driving market growth.

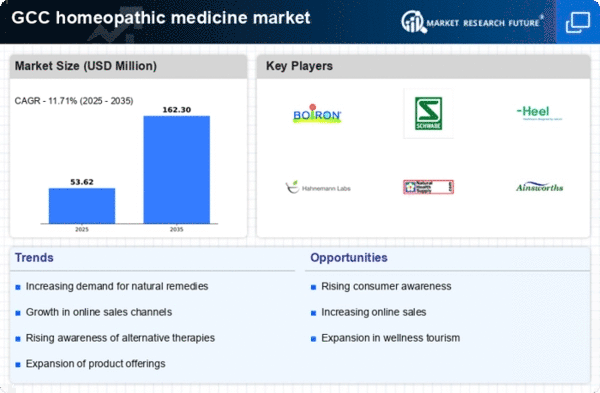

Increasing Demand for Natural Remedies

The homeopathic medicine market is experiencing a notable surge in demand for natural remedies, particularly within the GCC region. Consumers are increasingly seeking alternatives to conventional pharmaceuticals, driven by a growing awareness of the potential side effects associated with synthetic drugs. This shift towards natural solutions is reflected in market data, indicating that the homeopathic segment has expanded by approximately 15% annually over the past few years. The inclination towards holistic health approaches, combined with the rising prevalence of chronic diseases, is likely to further bolster the homeopathic medicine market. As consumers prioritize wellness and preventive care, the market is poised for continued growth, suggesting a robust future for homeopathic products in the GCC.

Regulatory Support for Alternative Medicine

The homeopathic medicine market benefits from increasing regulatory support within the GCC, as governments recognize the importance of alternative medicine in healthcare. Regulatory bodies are establishing frameworks to ensure the safety and efficacy of homeopathic products, which enhances consumer confidence. For instance, recent initiatives have led to the registration of numerous homeopathic remedies, facilitating their availability in pharmacies and health stores. This regulatory environment is crucial for the market's expansion, as it not only legitimizes homeopathy but also encourages investment in research and development. The potential for collaboration between regulatory agencies and homeopathic practitioners may further strengthen the market, indicating a positive trajectory for the industry.

Rising Health Consciousness Among Consumers

There is a marked increase in health consciousness among consumers in the GCC, which is significantly impacting the homeopathic medicine market. As individuals become more informed about health and wellness, they are more inclined to explore alternative treatment options. This trend is evidenced by a 20% increase in the number of consumers opting for homeopathic solutions over traditional medications. The growing emphasis on preventive healthcare and the desire for personalized treatment plans are driving this shift. Consequently, the homeopathic medicine market is likely to see sustained growth as more consumers seek out natural and holistic approaches to health management.

Cultural Acceptance of Alternative Therapies

Cultural acceptance of alternative therapies is a significant driver for the homeopathic medicine market in the GCC. Many consumers are increasingly open to integrating homeopathic treatments into their healthcare routines, influenced by traditional practices and holistic health philosophies. This acceptance is supported by a growing body of evidence highlighting the effectiveness of homeopathy in treating various ailments. As cultural attitudes shift towards embracing diverse medical practices, the homeopathic medicine market is expected to flourish. The potential for collaboration between homeopathic practitioners and conventional healthcare providers may further enhance the legitimacy and reach of homeopathic solutions in the region.