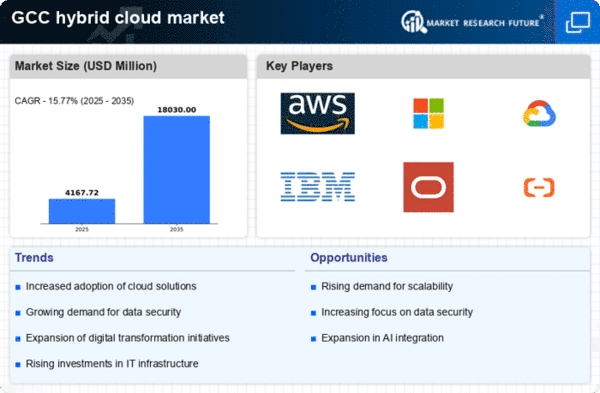

The hybrid cloud market is currently characterized by intense competition and rapid growth, driven by increasing demand for flexible IT solutions and the need for businesses to enhance operational efficiency. Major players such as Amazon Web Services (US), Microsoft (US), and Google Cloud (US) are at the forefront, each adopting distinct strategies to solidify their market positions. Amazon Web Services (US) continues to innovate its service offerings, focusing on enhancing its cloud infrastructure and expanding its global reach. Microsoft (US) emphasizes its integration of AI capabilities into its cloud services, aiming to provide advanced analytics and machine learning tools to its clients. Meanwhile, Google Cloud (US) is concentrating on partnerships and collaborations to enhance its service portfolio, particularly in data analytics and machine learning, which are increasingly vital for businesses seeking to leverage big data.

The competitive structure of the hybrid cloud market appears moderately fragmented, with several key players exerting substantial influence. Companies are employing various business tactics, such as localizing their services to meet regional demands and optimizing supply chains to enhance service delivery. This localized approach not only caters to specific market needs but also fosters customer loyalty, thereby strengthening their competitive edge. The collective influence of these major players shapes the market dynamics, as they continuously adapt to evolving customer expectations and technological advancements.

In October 2025, Amazon Web Services (US) announced the launch of its new hybrid cloud solution, designed to seamlessly integrate on-premises infrastructure with its cloud services. This strategic move is likely to enhance its appeal to enterprises looking for flexible and scalable solutions, thereby reinforcing its leadership position in the market. The introduction of this solution may also signify AWS's commitment to addressing the growing demand for hybrid cloud environments, which allow businesses to maintain control over sensitive data while leveraging the scalability of cloud resources.

In September 2025, Microsoft (US) unveiled a significant partnership with a leading telecommunications provider in the GCC region, aimed at enhancing its cloud connectivity and service delivery. This collaboration is expected to improve network performance and reliability for customers, thereby positioning Microsoft as a preferred choice for businesses seeking robust hybrid cloud solutions. The strategic importance of this partnership lies in its potential to expand Microsoft's market share and enhance its competitive positioning in a rapidly evolving landscape.

In August 2025, Google Cloud (US) expanded its data analytics capabilities by acquiring a prominent analytics firm, which is anticipated to bolster its offerings in the hybrid cloud space. This acquisition reflects Google Cloud's strategy to enhance its technological capabilities and provide more comprehensive solutions to its clients. The integration of advanced analytics tools is likely to attract businesses looking to harness the power of data for informed decision-making, thereby strengthening Google Cloud's competitive stance.

As of November 2025, the hybrid cloud market is witnessing trends such as increased digitalization, a focus on sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and collaboration. Moving forward, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. Companies that can effectively leverage these trends are likely to gain a competitive advantage, positioning themselves as leaders in the hybrid cloud market.