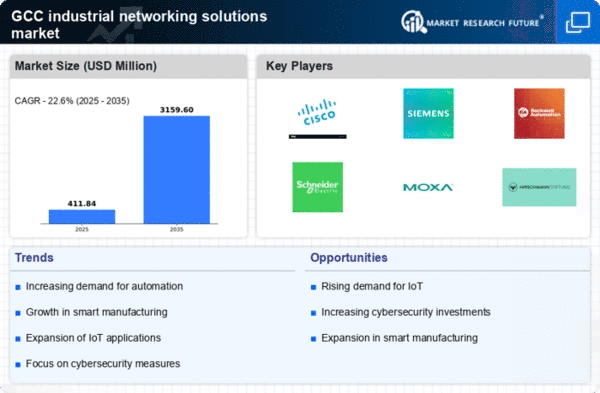

The industrial networking-solutions market is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for automation across various sectors. Key players such as Cisco Systems (US), Siemens (DE), and Rockwell Automation (US) are strategically positioned to leverage their extensive portfolios and innovative capabilities. Cisco Systems (US) focuses on enhancing its networking solutions through continuous investment in cybersecurity and IoT technologies, while Siemens (DE) emphasizes digital transformation initiatives, integrating AI and machine learning into its offerings. Rockwell Automation (US) is actively pursuing partnerships to expand its reach in the industrial sector, particularly in smart manufacturing, which collectively shapes a competitive environment that is increasingly reliant on technological innovation and strategic collaborations.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency and responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting significant influence. This fragmentation allows for a diverse range of solutions, catering to various industrial needs while fostering competition that drives innovation and service quality.

In October 2025, Siemens (DE) announced a strategic partnership with a leading cloud service provider to enhance its digital offerings in the industrial sector. This collaboration aims to integrate cloud-based solutions with Siemens' existing automation technologies, thereby enabling customers to leverage data analytics for improved operational efficiency. The strategic importance of this partnership lies in its potential to position Siemens as a frontrunner in the digital transformation of industrial processes, aligning with the growing trend towards data-driven decision-making.

In September 2025, Rockwell Automation (US) launched a new suite of cybersecurity solutions tailored for industrial environments. This initiative reflects the increasing emphasis on securing industrial networks against cyber threats, which have become a critical concern for manufacturers. By prioritizing cybersecurity, Rockwell Automation not only addresses a pressing market need but also enhances its value proposition, potentially attracting new customers seeking robust security measures.

In August 2025, Cisco Systems (US) unveiled an advanced networking solution designed specifically for smart factories. This solution integrates IoT capabilities with real-time data processing, enabling manufacturers to optimize their operations and reduce downtime. The introduction of this technology underscores Cisco's commitment to innovation and its strategic focus on the industrial sector, positioning the company to capitalize on the growing demand for smart manufacturing solutions.

As of November 2025, current competitive trends in the industrial networking-solutions market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the landscape, as companies recognize the need for collaborative approaches to address complex industrial challenges. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancements, and supply chain reliability, suggesting a shift in how companies position themselves in the market.