Rising Demand for Automation

The increasing demand for automation across various sectors in the GCC is a pivotal driver for the iot digital-transformation market. Industries such as manufacturing, logistics, and healthcare are actively seeking to enhance operational efficiency through automated solutions. According to recent data, the automation market in the GCC is projected to grow at a CAGR of 15% from 2025 to 2030. This trend indicates a robust appetite for IoT technologies that facilitate real-time monitoring and control, thereby streamlining processes and reducing costs. As organizations strive to remain competitive, the integration of IoT solutions becomes essential, further propelling the growth of the iot digital-transformation market. The push towards automation not only enhances productivity but also fosters innovation, creating a conducive environment for IoT adoption.

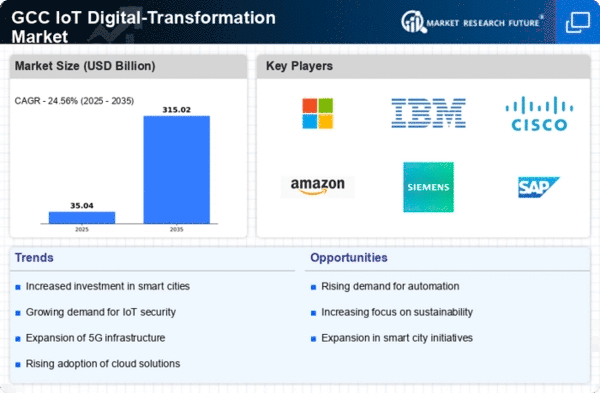

Expansion of 5G Infrastructure

The rollout of 5G networks across the GCC is significantly influencing the iot digital-transformation market. With enhanced data speeds and reduced latency, 5G technology enables a new wave of IoT applications that were previously unattainable. The GCC countries are investing heavily in 5G infrastructure, with estimates suggesting that the region will see a 30% increase in IoT device connectivity by 2026. This expansion allows for more devices to be connected simultaneously, facilitating smarter cities and advanced industrial applications. As businesses leverage 5G capabilities, the demand for IoT solutions that can harness this technology is expected to surge, thereby driving the growth of the iot digital-transformation market. The implications of 5G extend beyond mere connectivity; they encompass enhanced data analytics and real-time decision-making capabilities.

Increased Focus on Sustainability

Sustainability has emerged as a critical focus for businesses in the GCC, influencing the iot digital-transformation market. Organizations are increasingly adopting IoT solutions to monitor and reduce their environmental impact. For instance, smart energy management systems are being implemented to optimize energy consumption, leading to potential savings of up to 20% in operational costs. The GCC's commitment to sustainability, as evidenced by various national initiatives, is likely to drive the adoption of IoT technologies that support eco-friendly practices. This trend not only aligns with global sustainability goals but also enhances corporate social responsibility, making it a compelling driver for the iot digital-transformation market. As companies strive to meet regulatory requirements and consumer expectations, the integration of IoT solutions becomes a strategic imperative.

Emergence of Data-Driven Decision Making

The shift towards data-driven decision making is reshaping the landscape of the iot digital-transformation market in the GCC. Organizations are increasingly recognizing the value of data analytics in enhancing operational efficiency and customer engagement. The proliferation of IoT devices generates vast amounts of data, which can be harnessed to derive actionable insights. Recent studies indicate that companies leveraging data analytics can improve their decision-making speed by up to 40%. This trend underscores the importance of integrating IoT solutions that facilitate data collection and analysis. As businesses strive to become more agile and responsive to market changes, the demand for IoT technologies that support data-driven strategies is expected to grow, further driving the iot digital-transformation market.

Growing Investment in Smart Infrastructure

The GCC is witnessing a surge in investments aimed at developing smart infrastructure, which serves as a crucial driver for the iot digital-transformation market. Governments and private entities are channeling funds into projects that incorporate IoT technologies for improved urban management and service delivery. For example, smart transportation systems are being deployed to enhance traffic flow and reduce congestion, potentially decreasing travel times by 25%. This investment trend is indicative of a broader commitment to modernizing infrastructure, which is essential for supporting the increasing urban population. As smart infrastructure projects proliferate, the demand for IoT solutions that facilitate connectivity and data exchange will likely escalate, thereby propelling the growth of the iot digital-transformation market.