Rising Demand for 3D Modeling

The growing demand for 3D modeling across various sectors is significantly impacting the laser scanner market. Industries such as architecture, construction, and heritage preservation are increasingly utilizing 3D models for visualization and analysis. Laser scanners facilitate the creation of highly accurate 3D representations of physical spaces, which are essential for design and planning processes. In the GCC, the market is projected to grow by approximately 18% as organizations seek to enhance their design capabilities and improve project outcomes. The ability to visualize complex structures in three dimensions allows for better decision-making and reduces the likelihood of costly errors during construction. This trend underscores the importance of laser scanning technology in modern design and engineering practices.

Focus on Safety and Compliance

The emphasis on safety and regulatory compliance in construction and engineering projects is driving the laser scanner market. In the GCC, stringent safety standards and regulations necessitate accurate documentation and monitoring of construction sites. Laser scanners provide precise data that can be used for safety assessments and compliance verification, ensuring that projects adhere to local regulations. The market is expected to grow at a rate of around 10% as companies increasingly adopt laser scanning technology to enhance safety protocols. Furthermore, the ability to create detailed as-built documentation aids in maintaining compliance throughout the project lifecycle, making laser scanners vital tools for risk management and quality assurance in the construction industry.

Increased Adoption in Surveying

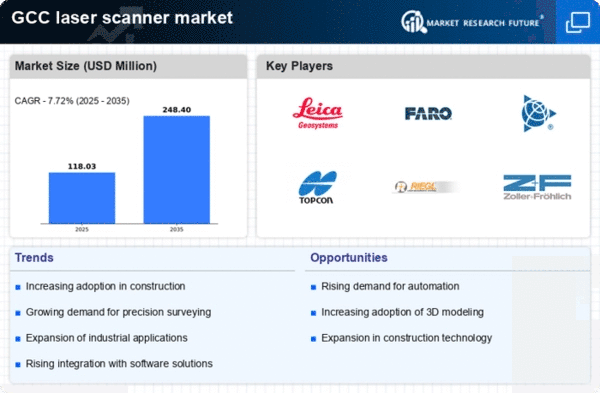

The laser scanner market is experiencing heightened adoption within the surveying sector, particularly in the GCC region. This trend is driven by the need for precise measurements and detailed topographical data. The integration of laser scanning technology allows surveyors to capture complex geometries and large areas efficiently. As a result, the market is projected to grow at a CAGR of approximately 15% over the next five years. The ability to produce 3D models and digital terrain maps enhances the accuracy of land assessments, making laser scanners indispensable tools for modern surveying practices. Furthermore, the demand for high-resolution data in urban planning and infrastructure development is likely to propel the laser scanner market further, as stakeholders seek to optimize project outcomes.

Expansion in Infrastructure Projects

The ongoing expansion of infrastructure projects across the GCC is significantly influencing the laser scanner market. Governments in the region are investing heavily in transportation, utilities, and urban development, which necessitates advanced surveying and mapping solutions. Laser scanners provide rapid data collection and analysis, which is crucial for large-scale projects such as highways, bridges, and airports. The market is expected to witness a growth rate of around 12% annually, driven by these infrastructure initiatives. Additionally, the ability to integrate laser scanning data with Building Information Modeling (BIM) enhances project efficiency and collaboration among stakeholders, further solidifying the role of laser scanners in the construction and engineering sectors.

Technological Integration with Drones

The integration of laser scanning technology with drone systems is emerging as a transformative driver for the laser scanner market. In the GCC, the use of drones equipped with laser scanners allows for the rapid collection of data over vast areas, which is particularly beneficial in remote or difficult-to-access locations. This synergy enhances the efficiency of data acquisition and reduces the time required for surveying tasks. The market is likely to see a surge in demand for this combined technology, with projections indicating a growth of approximately 20% in the next few years. As industries increasingly recognize the advantages of aerial surveying, the laser scanner market is poised to expand, offering innovative solutions for various applications, including environmental monitoring and land use planning.