Rising Demand for Operational Efficiency

The manufacturing analytics market is experiencing a notable surge in demand for operational efficiency across various sectors in the GCC. Companies are increasingly recognizing the need to optimize their production processes to reduce waste and enhance productivity. This trend is driven by the competitive landscape, where organizations strive to maintain profitability amidst fluctuating market conditions. According to recent data, the manufacturing sector in the GCC is projected to grow at a CAGR of 5.2% from 2025 to 2030, indicating a robust appetite for analytics solutions that can streamline operations. By leveraging advanced analytics, manufacturers can identify bottlenecks, improve supply chain management, and ultimately achieve higher output levels. This focus on operational efficiency is likely to propel the growth of the manufacturing analytics market in the region.

Growing Need for Real-Time Decision Making

The manufacturing analytics market is experiencing a growing need for real-time decision-making capabilities among manufacturers in the GCC. In an era where market dynamics are constantly changing, organizations require timely insights to respond effectively to emerging challenges and opportunities. The ability to analyze data in real-time allows manufacturers to make informed decisions that can enhance operational agility and competitiveness. Recent surveys indicate that 70% of manufacturers in the GCC are prioritizing investments in analytics solutions that provide real-time data visibility. This trend underscores the importance of manufacturing analytics in enabling organizations to adapt swiftly to market demands. As the need for agility and responsiveness continues to rise, the manufacturing analytics market is likely to see sustained growth in the coming years.

Advancements in Data Analytics Technologies

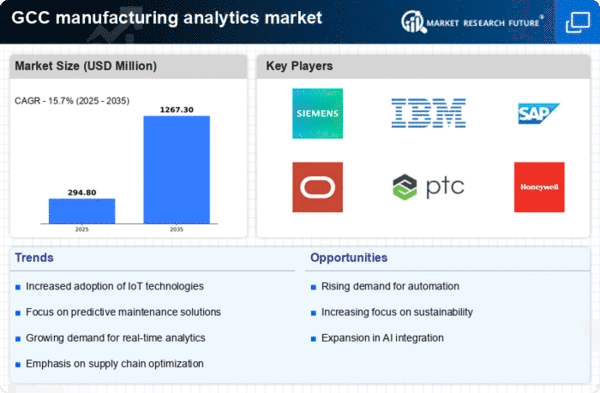

The manufacturing analytics market is benefiting from rapid advancements in data analytics technologies, which are transforming how manufacturers operate in the GCC. Innovations in machine learning, artificial intelligence, and big data analytics are enabling organizations to extract actionable insights from vast amounts of data generated during production processes. These technologies facilitate predictive maintenance, quality control, and real-time monitoring, thereby enhancing overall operational performance. As manufacturers increasingly adopt these advanced analytics tools, the market is expected to expand significantly. Reports suggest that the adoption of AI-driven analytics in manufacturing could lead to a 30% reduction in downtime and a 25% increase in production efficiency. This technological evolution is likely to be a key driver for the growth of the manufacturing analytics market in the region.

Increased Investment in Smart Manufacturing

The manufacturing analytics market is witnessing a significant increase in investments in smart manufacturing initiatives within the GCC. Governments and private enterprises are allocating substantial resources to modernize their manufacturing capabilities through the adoption of advanced technologies. This shift is evident as the GCC countries aim to diversify their economies and reduce reliance on oil revenues. For instance, the UAE has committed to investing over $70 billion in smart manufacturing technologies by 2030. Such investments are expected to enhance data collection and analysis, thereby driving the demand for manufacturing analytics solutions. As manufacturers embrace automation and data-driven decision-making, the manufacturing analytics market is poised for substantial growth, reflecting the region's commitment to innovation and technological advancement.

Emphasis on Sustainability and Environmental Compliance

The manufacturing analytics market is influenced by the growing emphasis on sustainability and environmental compliance in the GCC. As regulatory frameworks become more stringent, manufacturers are compelled to adopt practices that minimize their environmental impact. This shift is prompting organizations to utilize analytics to monitor and optimize resource consumption, waste management, and emissions. Recent studies indicate that companies implementing sustainable practices can achieve cost savings of up to 20% through improved resource efficiency. Consequently, the demand for manufacturing analytics solutions that facilitate compliance with environmental regulations is likely to rise. By integrating sustainability metrics into their analytics frameworks, manufacturers can not only meet regulatory requirements but also enhance their brand reputation and appeal to environmentally conscious consumers.