Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare infrastructure in the GCC are significantly impacting the medical device-connectivity market. Various national health strategies are being implemented to promote the adoption of advanced medical technologies. For instance, the UAE's Vision 2021 emphasizes the importance of innovation in healthcare, which includes the integration of connected medical devices. Additionally, funding programs are being established to support research and development in this sector. The allocation of resources towards digital health solutions is expected to increase, potentially leading to a market growth rate of 15% by 2026. Such governmental support is likely to catalyze advancements in the medical device-connectivity market.

Growing Focus on Patient-Centric Care

The shift towards patient-centric care is significantly influencing the medical device-connectivity market. Healthcare providers in the GCC are increasingly prioritizing patient engagement and satisfaction, which necessitates the use of connected medical devices. These devices enable patients to take an active role in their health management, fostering better communication between patients and healthcare professionals. The emphasis on personalized healthcare solutions is likely to drive the adoption of connected devices, as they provide tailored health insights and facilitate remote consultations. This trend may contribute to a projected market growth of 18% by 2027, as more healthcare systems recognize the value of integrating connectivity into patient care.

Rising Demand for Remote Patient Monitoring

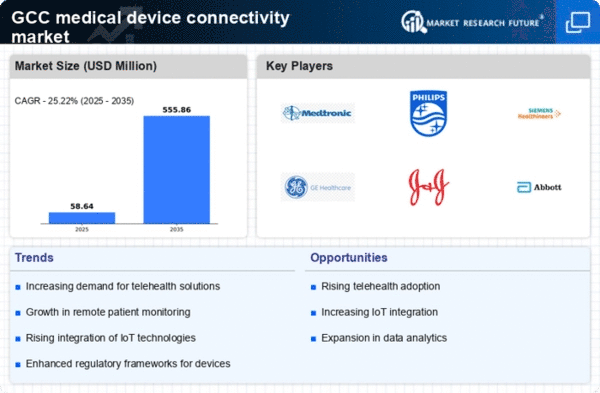

The medical device-connectivity market is experiencing a notable surge in demand for remote patient monitoring solutions. This trend is driven by the increasing prevalence of chronic diseases in the GCC region, which necessitates continuous health monitoring. According to recent data, the GCC healthcare sector is projected to grow at a CAGR of 12% from 2023 to 2028, indicating a robust market for connected medical devices. Remote monitoring not only enhances patient engagement but also reduces hospital readmission rates, thereby improving overall healthcare efficiency. As healthcare providers seek to optimize patient outcomes while managing costs, the integration of connected devices into patient care strategies appears to be a pivotal factor in the evolution of the medical device-connectivity market.

Increased Investment in Digital Health Startups

Investment in digital health startups is emerging as a key driver for the medical device-connectivity market. Venture capital funding in the GCC region has seen a significant uptick, with investors recognizing the potential of innovative health technologies. In 2025, investments in digital health are expected to reach approximately $500 million, reflecting a growing interest in solutions that enhance connectivity and data management in healthcare. This influx of capital is likely to accelerate the development of new connected medical devices and applications, fostering competition and innovation within the market. As startups introduce novel solutions, the medical device-connectivity market is poised for dynamic growth.

Technological Advancements in Connectivity Solutions

Technological advancements are playing a crucial role in shaping the medical device-connectivity market. Innovations in wireless communication technologies, such as 5G and IoT, are enhancing the capabilities of medical devices, allowing for real-time data transmission and improved patient monitoring. The GCC region is witnessing a rapid rollout of 5G networks, which is expected to facilitate the deployment of connected medical devices. This technological evolution not only improves the efficiency of healthcare delivery but also enhances the accuracy of patient data collection. As a result, healthcare providers are increasingly investing in connected solutions, which could lead to a market expansion of approximately 20% over the next five years.