Emergence of 5G Technology

The rollout of 5G technology is poised to revolutionize the mobile front-haul market in the GCC. With its promise of ultra-low latency and significantly higher data rates, 5G is expected to drive substantial investments in mobile front-haul infrastructure. Industry analysts suggest that the mobile front-haul market could see an increase in revenue by over 40% as telecom operators upgrade their networks to accommodate 5G requirements. This transition necessitates the deployment of new fiber-optic links and advanced transport solutions, thereby creating opportunities for innovation within the mobile front-haul market. As 5G adoption accelerates, the demand for efficient and scalable front-haul solutions will likely intensify.

Adoption of Virtualized Network Functions

The mobile front-haul market is witnessing a shift towards the adoption of virtualized network functions (VNFs) as operators seek to enhance operational efficiency. By leveraging VNFs, telecom providers can reduce hardware costs and improve scalability, allowing for more agile responses to changing market demands. This trend is particularly relevant in the GCC, where rapid urbanization and population growth are driving the need for flexible network solutions. The mobile front-haul market is thus likely to see increased collaboration between technology vendors and service providers to develop and implement VNFs, ultimately leading to more efficient and cost-effective network management.

Rising Demand for High-Speed Connectivity

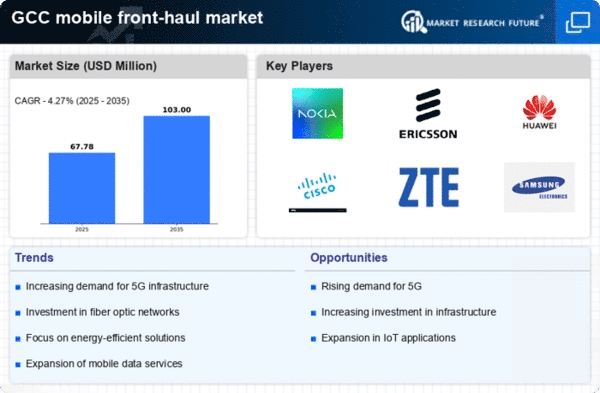

The mobile front-haul market is experiencing a surge in demand for high-speed connectivity, driven by the increasing number of mobile users in the GCC region. As mobile data traffic continues to grow, with projections indicating a compound annual growth rate (CAGR) of approximately 30% over the next five years, telecom operators are compelled to enhance their infrastructure. This demand for faster and more reliable connections is pushing investments into mobile front-haul technologies. The mobile front-haul market is thus witnessing a shift towards advanced solutions that can support higher bandwidth requirements, ensuring that service providers can meet customer expectations and remain competitive in a rapidly evolving digital landscape.

Government Initiatives for Digital Transformation

In the GCC, government initiatives aimed at digital transformation are significantly influencing the mobile front-haul market. Various national strategies, such as Saudi Arabia's Vision 2030 and the UAE's Smart City initiatives, emphasize the importance of robust telecommunications infrastructure. These initiatives are likely to lead to increased funding and support for mobile front-haul projects, as governments recognize the necessity of modernizing their networks to facilitate economic growth. The mobile front-haul market stands to benefit from these developments, as public-private partnerships may emerge to accelerate the deployment of advanced technologies, ultimately enhancing connectivity and service delivery across the region.

Increased Focus on Network Reliability and Resilience

As the mobile front-haul market evolves, there is a growing emphasis on network reliability and resilience among service providers in the GCC. The increasing reliance on mobile networks for critical services necessitates robust infrastructure capable of withstanding disruptions. This focus on reliability is driving investments in redundant systems and advanced monitoring technologies. The mobile front-haul market is thus adapting to these needs by developing solutions that enhance network performance and minimize downtime. With the potential for increased regulatory scrutiny on service quality, operators are likely to prioritize investments in resilient front-haul systems to maintain customer trust and satisfaction.