Growing Aging Population

The demographic shift towards an aging population in the GCC is significantly impacting the oem patient-monitoring-vital-sign-oem-module market. As the elderly population increases, there is a heightened need for continuous health monitoring to manage age-related health issues effectively. Reports indicate that by 2030, the number of individuals aged 60 and above in the GCC is expected to double, leading to a greater demand for monitoring solutions that cater to this demographic. This trend underscores the importance of developing specialized oem modules that address the unique health needs of older adults, thereby driving market growth and innovation.

Integration of IoT in Healthcare

The integration of Internet of Things (IoT) technology into healthcare systems is transforming the oem patient-monitoring-vital-sign-oem-module market. IoT-enabled devices facilitate real-time data collection and analysis, allowing healthcare professionals to monitor patients' vital signs remotely. This technological advancement not only improves patient outcomes but also enhances operational efficiency within healthcare facilities. The GCC region is witnessing a surge in IoT adoption, with investments in smart healthcare solutions expected to exceed $20 billion by 2025. This trend suggests that the oem patient-monitoring-vital-sign-oem-module market will benefit from increased demand for interconnected devices that provide seamless data exchange and improved patient management.

Rising Awareness of Health and Wellness

There is a growing awareness of health and wellness among the population in the GCC, which is driving the demand for monitoring solutions in the oem patient-monitoring-vital-sign-oem-module market. As individuals become more proactive about their health, the need for reliable monitoring devices that provide accurate vital sign readings is increasing. This trend is reflected in the rising sales of wearable health devices and home monitoring systems. The market for these solutions is expected to grow at a CAGR of 15% over the next five years, indicating a robust demand for innovative oem modules that cater to health-conscious consumers.

Rising Demand for Remote Patient Monitoring

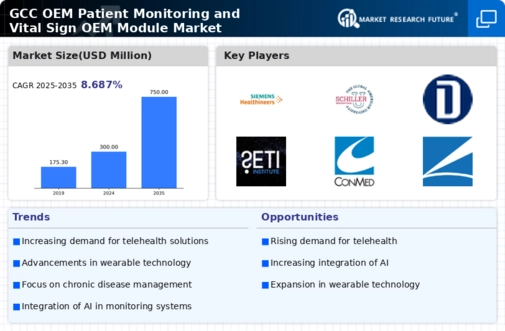

The increasing prevalence of chronic diseases in the GCC region is driving the demand for remote patient monitoring solutions. As healthcare providers seek to enhance patient care while reducing costs, the oem patient-monitoring-vital-sign-oem-module market is experiencing significant growth. According to recent data, the GCC healthcare market is projected to reach $100 billion by 2025, with a substantial portion allocated to advanced monitoring technologies. This trend indicates a shift towards more efficient healthcare delivery systems, where remote monitoring modules play a crucial role in managing patient health. The convenience and efficiency of these solutions are likely to attract both healthcare providers and patients, further propelling the market forward.

Increased Investment in Healthcare Infrastructure

The GCC governments are making substantial investments in healthcare infrastructure, which is positively influencing the oem patient-monitoring-vital-sign-oem-module market. Initiatives aimed at enhancing healthcare facilities and services are creating opportunities for the adoption of advanced monitoring technologies. For instance, the UAE's Vision 2021 aims to improve healthcare services, with a focus on integrating technology into patient care. This commitment to healthcare development is likely to result in increased procurement of oem patient-monitoring-vital-sign-oem-modules, as healthcare providers seek to modernize their equipment and improve patient outcomes.