Rising Healthcare Costs

The escalating costs associated with healthcare services in the GCC region are driving the pharmacy benefit-management-services market. As healthcare expenditures continue to rise, employers and insurers are increasingly seeking effective management solutions to control costs. The pharmacy benefit-management-services market plays a crucial role in negotiating drug prices and managing formularies, which can lead to substantial savings. Reports indicate that healthcare spending in the GCC is projected to reach $104 billion by 2025, highlighting the urgent need for cost-effective pharmacy benefit solutions. This trend suggests that organizations are likely to invest more in pharmacy benefit-management services to mitigate rising costs and enhance the overall efficiency of their healthcare spending.

Focus on Preventive Care

The emphasis on preventive care within the GCC healthcare system is driving the pharmacy benefit-management-services market. As healthcare stakeholders recognize the importance of preventing diseases rather than merely treating them, pharmacy benefit managers are adapting their services to promote preventive medications and health screenings. This shift is likely to enhance patient outcomes and reduce long-term healthcare costs. The pharmacy benefit-management-services market is expected to play a pivotal role in facilitating access to preventive medications, thereby aligning with the broader healthcare goals of improving population health and reducing the burden of chronic diseases.

Regulatory Changes and Compliance

Regulatory changes in the GCC are influencing the pharmacy benefit-management-services market. Governments are implementing new policies aimed at improving healthcare access and affordability, which directly impacts pharmacy benefits. Compliance with these regulations is essential for pharmacy benefit managers to operate effectively. As regulations evolve, pharmacy benefit-management services must adapt to ensure they meet the requirements while still providing value to clients. This dynamic environment suggests that organizations will increasingly rely on pharmacy benefit-management services to navigate the complexities of regulatory compliance and maintain competitive advantage in the market.

Increased Chronic Disease Prevalence

The growing prevalence of chronic diseases in the GCC region is significantly impacting the pharmacy benefit-management-services market. Chronic conditions such as diabetes, hypertension, and cardiovascular diseases require ongoing medication management, which necessitates effective pharmacy benefit strategies. As the population ages and lifestyle-related diseases become more common, the demand for pharmacy benefit-management services is expected to rise. It is estimated that by 2025, chronic diseases will account for approximately 70% of all healthcare expenditures in the region. This trend indicates that pharmacy benefit-management services will be essential in managing medication adherence and optimizing treatment outcomes for patients with chronic conditions.

Technological Advancements in Healthcare

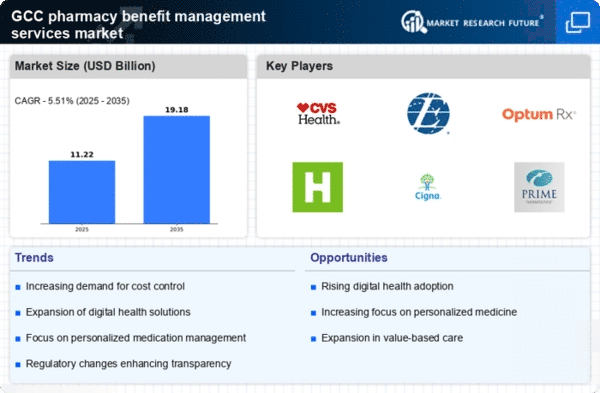

Technological innovations are reshaping the pharmacy benefit-management-services market in the GCC. The integration of advanced data analytics, artificial intelligence, and telehealth solutions is enhancing the efficiency and effectiveness of pharmacy benefit programs. These technologies enable better tracking of medication usage, improved patient engagement, and more accurate forecasting of drug costs. As healthcare providers and payers increasingly adopt these technologies, the pharmacy benefit-management-services market is likely to experience significant growth. The market is projected to expand at a CAGR of 8% from 2025 to 2030, driven by the demand for more sophisticated and data-driven pharmacy benefit solutions.