Rising Cybersecurity Threats

The increasing frequency and sophistication of cyber threats in the GCC region is a primary driver for the runtime application-self-protection market. Organizations are facing a surge in attacks, including ransomware and data breaches, which necessitate robust security measures. According to recent reports, cybercrime costs in the GCC are projected to reach $25 billion by 2025, highlighting the urgent need for advanced protective solutions. As businesses strive to safeguard sensitive data and maintain customer trust, the demand for runtime application-self-protection technologies is likely to escalate. This market segment is expected to grow as companies prioritize proactive security measures to mitigate risks associated with application vulnerabilities.

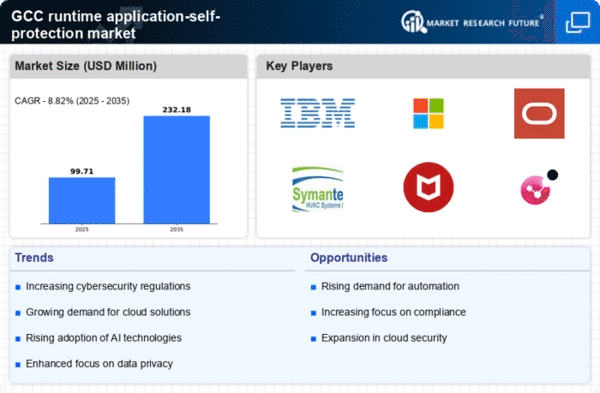

Increased Regulatory Pressures

Regulatory frameworks in the GCC are becoming more stringent, compelling organizations to adopt comprehensive security measures, including runtime application-self-protection solutions. Compliance with regulations such as the UAE's Data Protection Law and Saudi Arabia's Personal Data Protection Law is driving the demand for advanced security technologies. Companies face substantial penalties for non-compliance, which can reach up to 4% of annual revenue. This regulatory environment is likely to propel the runtime application-self-protection market as organizations seek to align their security practices with legal requirements, ensuring that their applications are resilient against potential breaches.

Shift Towards DevSecOps Practices

The integration of security into the software development lifecycle, known as DevSecOps, is emerging as a crucial driver for the runtime application-self-protection market. As organizations in the GCC adopt agile methodologies, the need for embedding security measures within the development process becomes paramount. This shift not only enhances the security posture of applications but also accelerates the deployment of secure software. By 2025, it is anticipated that over 60% of organizations in the region will implement DevSecOps practices, thereby increasing the demand for runtime application-self-protection solutions that can seamlessly integrate into these workflows.

Rising Awareness of Application Security

There is a growing awareness among businesses in the GCC regarding the importance of application security, which is significantly impacting the runtime application-self-protection market. As organizations recognize that traditional security measures are insufficient to protect against sophisticated attacks, they are increasingly turning to advanced solutions that provide real-time protection. Educational initiatives and industry collaborations are fostering a culture of security awareness, leading to higher investments in runtime application-self-protection technologies. This trend is expected to continue, with organizations prioritizing application security as a critical component of their overall cybersecurity strategy.

Growing Digital Transformation Initiatives

The ongoing digital transformation across various sectors in the GCC is significantly influencing the runtime application-self-protection market. As organizations increasingly adopt digital technologies, the attack surface expands, making applications more vulnerable to threats. The GCC's push towards smart cities and e-governance initiatives further amplifies this need. In 2025, it is estimated that the digital economy in the region will contribute over $100 billion to GDP, underscoring the importance of securing applications in this evolving landscape. Consequently, businesses are investing in runtime application-self-protection solutions to ensure that their digital assets are adequately protected against emerging threats.