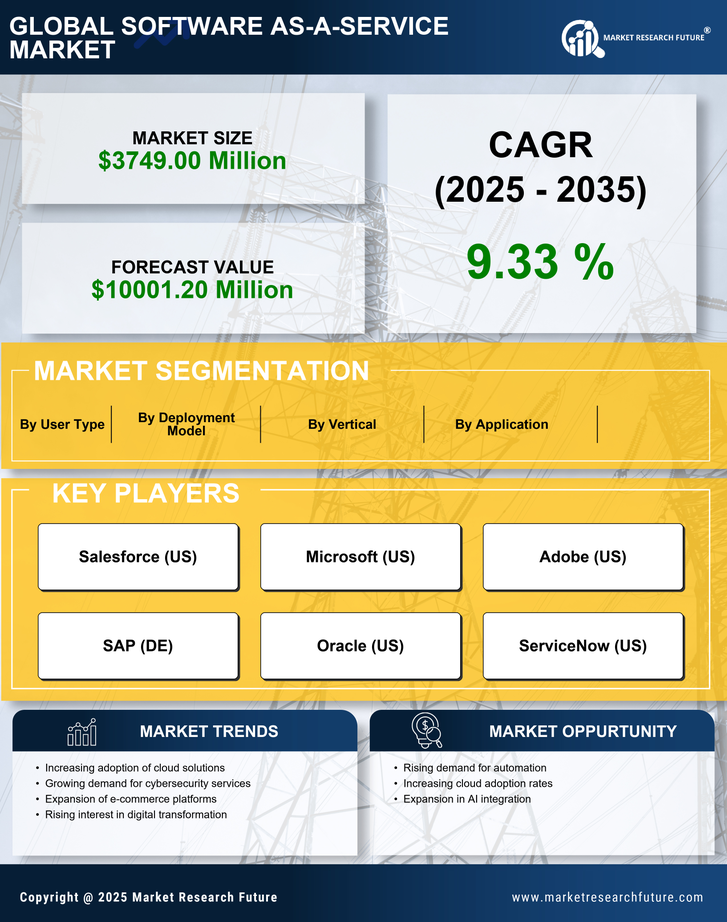

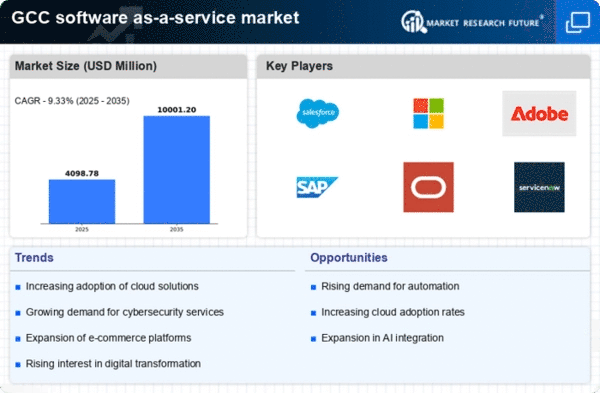

Cost Efficiency and Scalability

Cost efficiency remains a pivotal driver in the software as-a-service market, particularly within the GCC. Organizations are increasingly drawn to SaaS solutions due to their subscription-based pricing models, which eliminate the need for substantial upfront investments in hardware and software. This model allows businesses to scale their operations seamlessly, paying only for what they use. Recent statistics indicate that companies utilizing SaaS can reduce IT costs by up to 30%. As firms in the GCC seek to optimize their budgets while maintaining operational effectiveness, the software as-a-service market is likely to see sustained growth driven by this emphasis on cost efficiency and scalability.

Growing Demand for Remote Work Solutions

The software as-a-service market is experiencing a notable surge in demand for remote work solutions across the GCC region. Organizations are increasingly adopting cloud-based applications to facilitate collaboration and productivity among distributed teams. This shift is driven by the need for flexibility and efficiency in operations. According to recent data, the adoption of remote work tools has increased by approximately 40% in the last year alone. This trend is likely to continue as businesses recognize the benefits of SaaS solutions in enhancing workforce mobility and reducing operational costs. The software as-a-service market is thus positioned to capitalize on this growing demand, offering innovative solutions that cater to the evolving needs of remote work environments.

Regulatory Compliance and Data Governance

The software as-a-service market is significantly influenced by the increasing focus on regulatory compliance and data governance in the GCC. As data protection laws become more stringent, organizations are compelled to adopt SaaS solutions that ensure compliance with local regulations. This necessity is underscored by the fact that non-compliance can result in hefty fines, potentially reaching millions of dollars. Consequently, businesses are prioritizing SaaS providers that offer robust security features and compliance certifications. The software as-a-service market is thus likely to thrive as companies seek reliable partners to navigate the complexities of regulatory landscapes.

Enhanced Customer Experience through Personalization

In the competitive landscape of the software as-a-service market, enhancing customer experience through personalization is becoming increasingly vital. Businesses in the GCC are leveraging SaaS solutions to gather and analyze customer data, enabling them to tailor their offerings to meet specific needs. This trend is supported by findings that suggest personalized services can lead to a 20% increase in customer satisfaction. As companies strive to differentiate themselves in a crowded marketplace, the software as-a-service market is poised to benefit from the growing emphasis on customer-centric solutions that enhance engagement and loyalty.

Integration of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation technologies is emerging as a transformative driver in the software as-a-service market. Companies in the GCC are increasingly adopting AI-driven SaaS solutions to enhance operational efficiency and decision-making processes. This trend is evidenced by a projected growth rate of 25% in AI-related SaaS applications over the next five years. By automating routine tasks and providing data-driven insights, these solutions enable organizations to focus on strategic initiatives. The software as-a-service market is thus well-positioned to leverage this technological advancement, offering innovative tools that align with the future of work.