Rising Aging Population

The increasing aging population in the GCC region is a pivotal driver for the spinal cord-compression-spinal-stenosis market. As individuals age, the likelihood of developing spinal disorders, including spinal stenosis, escalates significantly. Reports indicate that by 2030, the population aged 60 and above in GCC countries is expected to reach approximately 20% of the total population. This demographic shift is likely to result in a higher demand for diagnostic and therapeutic interventions related to spinal conditions. Consequently, healthcare providers may need to enhance their service offerings to cater to this growing segment, thereby propelling the spinal cord-compression-spinal-stenosis market forward.

Rising Incidence of Obesity

The rising incidence of obesity in the GCC region is emerging as a significant driver for the spinal cord-compression-spinal-stenosis market. Obesity is a known risk factor for various spinal disorders, including spinal stenosis, as excess weight can place additional strain on the spine. Recent statistics indicate that obesity rates in the GCC have reached alarming levels, with some countries reporting over 30% of the adult population classified as obese. This trend may lead to an increased prevalence of spinal conditions, thereby heightening the demand for treatment options within the spinal cord-compression-spinal-stenosis market.

Increased Awareness and Education

There is a growing awareness regarding spinal health and the implications of spinal disorders among the GCC population. Educational initiatives by healthcare organizations and government bodies are likely to play a crucial role in informing the public about the symptoms and treatment options for spinal stenosis. This heightened awareness may lead to earlier diagnosis and treatment, thereby increasing the patient pool seeking care for spinal conditions. As a result, the spinal cord-compression-spinal-stenosis market could experience a surge in demand for both conservative and surgical treatment options, reflecting a proactive approach to spinal health.

Advancements in Surgical Techniques

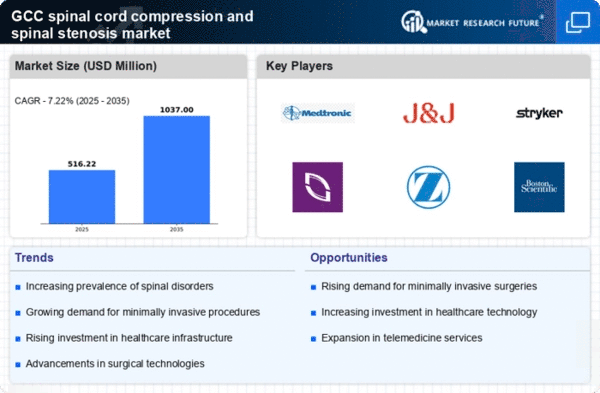

Innovations in surgical techniques are transforming the landscape of the spinal cord-compression-spinal-stenosis market. Minimally invasive procedures, such as endoscopic spine surgery, are gaining traction due to their reduced recovery times and lower complication rates. The adoption of these advanced techniques is likely to enhance patient outcomes and satisfaction, which may lead to increased demand for surgical interventions. Furthermore, the market for spinal implants and devices is projected to grow, with estimates suggesting a valuation of over $1 billion by 2026 in the GCC region. This growth indicates a robust market response to the evolving surgical landscape.

Investment in Healthcare Infrastructure

The GCC region is witnessing substantial investments in healthcare infrastructure, which is likely to bolster the spinal cord-compression-spinal-stenosis market. Governments are prioritizing the enhancement of healthcare facilities and services, aiming to provide comprehensive care for various medical conditions, including spinal disorders. This investment trend is expected to facilitate the establishment of specialized spinal clinics and rehabilitation centers, thereby improving access to care. As healthcare systems expand and modernize, the availability of advanced diagnostic tools and treatment modalities for spinal stenosis is likely to increase, further driving market growth.