Expansion of Digital Services

The rapid expansion of digital services in the GCC is significantly influencing the subscriber data-management market. As more businesses transition to digital platforms, the need for effective data management solutions becomes paramount. This shift is driven by the increasing reliance on online services, which has led to a surge in subscriber data generation. The market is projected to reach a valuation of $1 billion by 2026, reflecting the growing importance of data management in supporting digital transformation initiatives. Organizations are seeking solutions that can efficiently handle large volumes of data while ensuring accuracy and security, thereby propelling growth in the subscriber data-management market.

Regulatory Compliance Pressures

In the GCC, regulatory compliance is becoming a significant driver for the subscriber data-management market. Governments are implementing stringent data protection laws, which compel organizations to adopt robust data management practices. Compliance with regulations such as the General Data Protection Regulation (GDPR) and local data protection laws necessitates the use of advanced data management solutions. Companies are investing heavily in technologies that ensure data security and privacy, which is expected to increase market demand. The financial implications of non-compliance can be severe, with potential fines reaching up to €20 million or 4% of annual global turnover, thus making compliance a pivotal factor in the subscriber data-management market.

Growing Demand for Personalization

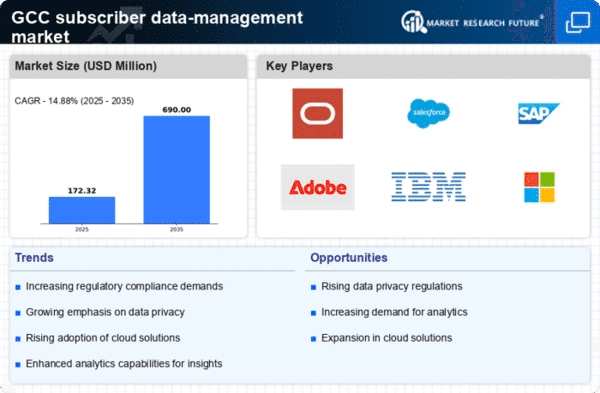

The subscriber data-management market is experiencing a notable surge in demand for personalized services. As businesses in the GCC region increasingly recognize the value of tailored customer experiences, they are investing in data management solutions that enable them to analyze subscriber behavior and preferences. This trend is reflected in the market, which is projected to grow at a CAGR of 15% over the next five years. Companies are leveraging advanced analytics to create targeted marketing campaigns, thereby enhancing customer engagement and retention. The ability to deliver personalized content not only improves customer satisfaction but also drives revenue growth, making it a critical driver in the subscriber data-management market.

Emergence of Artificial Intelligence

The integration of artificial intelligence (AI) technologies is emerging as a transformative driver in the subscriber data-management market. AI enables organizations to automate data processing and analysis, leading to enhanced efficiency and accuracy. In the GCC, businesses are increasingly adopting AI-driven solutions to gain insights from subscriber data, which can inform strategic decision-making. The market for AI in data management is expected to grow by 25% annually, as companies recognize the potential of AI to optimize customer interactions and improve service delivery. This technological advancement is likely to reshape the landscape of the subscriber data-management market, making it a crucial area of focus for organizations.

Increased Investment in Data Infrastructure

Investment in data infrastructure is a critical driver for the subscriber data-management market in the GCC. As organizations recognize the importance of robust data management systems, they are allocating significant resources to enhance their data capabilities. This trend is evidenced by a projected increase in spending on data infrastructure by 30% over the next three years. Companies are focusing on upgrading their data storage, processing, and analytics capabilities to support the growing volume of subscriber data. This investment not only improves operational efficiency but also positions organizations to better leverage data for strategic advantage, thereby fueling growth in the subscriber data-management market.