Regulatory Compliance and Standards

The evolving regulatory landscape in the GCC is compelling organizations to adopt analytics solutions that ensure compliance with various standards. The supply chain-analytics market is witnessing increased demand for tools that assist businesses in adhering to regulations related to safety, quality, and environmental impact. Companies are leveraging analytics to monitor compliance in real-time, thereby reducing the risk of penalties and enhancing their reputation. As regulatory requirements become more stringent, the market for supply chain analytics is expected to grow, with an estimated increase of 15% in the adoption of compliance-focused analytics solutions over the next few years.

Integration of Advanced Technologies

The integration of advanced technologies such as IoT and blockchain is significantly influencing the supply chain-analytics market. These technologies facilitate the collection and analysis of vast amounts of data, enabling organizations to gain deeper insights into their supply chain operations. For instance, IoT devices can provide real-time tracking of goods, while blockchain ensures transparency and traceability. In the GCC, the adoption of these technologies is projected to increase by approximately 30% over the next few years, as companies seek to enhance their operational capabilities. This technological evolution is likely to drive the demand for sophisticated analytics solutions, thereby propelling the growth of the supply chain-analytics market.

Focus on Risk Management and Resilience

In the current business landscape, the emphasis on risk management and resilience is becoming increasingly critical for organizations in the GCC. The supply chain-analytics market is responding to this need by offering tools that help businesses identify potential risks and develop strategies to mitigate them. Companies are investing in analytics solutions that provide predictive insights, enabling them to anticipate disruptions and respond proactively. This focus on resilience is expected to drive a growth rate of around 25% in the supply chain-analytics market as organizations prioritize the establishment of robust supply chains capable of withstanding unforeseen challenges.

Rising Demand for Supply Chain Efficiency

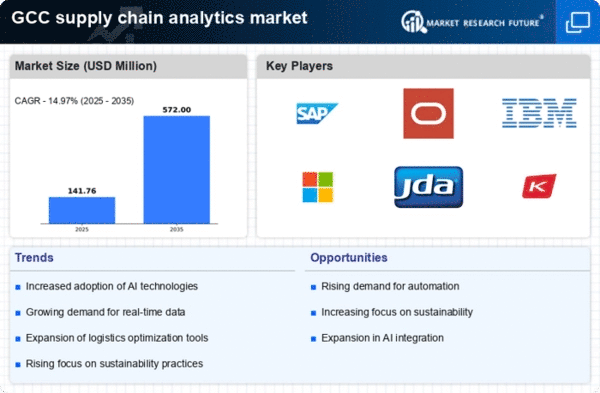

The supply chain-analytics market is experiencing a notable surge in demand for enhanced efficiency across various sectors in the GCC. Companies are increasingly recognizing the need to optimize their supply chain operations to reduce costs and improve service levels. According to recent data, organizations that implement advanced analytics can achieve up to 20% reduction in operational costs. This trend is driven by the need for real-time insights and data-driven decision-making, which are essential for maintaining competitiveness in a rapidly evolving market. As businesses strive to streamline their processes, the supply chain-analytics market is poised for significant growth, with investments in analytics tools and technologies expected to rise substantially in the coming years.

Growing E-commerce and Digital Transformation

The rapid growth of e-commerce in the GCC is significantly impacting the supply chain-analytics market. As online shopping continues to gain traction, businesses are increasingly turning to analytics to optimize their supply chain operations to meet consumer demands. The need for efficient inventory management, order fulfillment, and delivery logistics is driving the adoption of advanced analytics solutions. Recent studies indicate that e-commerce companies that utilize analytics can improve their delivery times by up to 30%. This trend is likely to propel the supply chain-analytics market forward, as organizations seek to enhance their capabilities in a digitally transformed landscape.