Emergence of 5G Technology

The rollout of 5G technology is poised to transform the telecom analytics market in the GCC. With its promise of ultra-fast connectivity and low latency, 5G is expected to generate unprecedented volumes of data. Telecom operators are increasingly investing in analytics solutions to harness this data effectively. By 2025, the telecom analytics market is anticipated to expand by approximately 25%, driven by the need for real-time analytics to manage 5G networks. This technology enables operators to gain insights into network performance, user behavior, and service quality, thereby enhancing customer experiences. The ability to analyze data in real-time is becoming essential for telecom companies to remain competitive in the evolving landscape of the telecom analytics market.

Enhanced Regulatory Frameworks

The establishment of enhanced regulatory frameworks is positively impacting the telecom analytics market. In the GCC, regulatory bodies are increasingly supporting innovation and the adoption of advanced analytics solutions. This supportive environment encourages telecom operators to invest in analytics capabilities, fostering competition and improving service quality. The telecom analytics market is expected to benefit from these regulatory advancements, with a projected growth rate of 12% as companies align their strategies with regulatory requirements. By adhering to these frameworks, telecom operators can ensure compliance while leveraging analytics to enhance customer experiences and operational performance. Thus, regulatory support is emerging as a crucial driver in the telecom analytics market.

Focus on Operational Efficiency

A growing emphasis on operational efficiency is shaping the telecom analytics market. Telecom operators in the GCC are increasingly adopting analytics solutions to streamline their operations and reduce costs. By leveraging data analytics, companies can identify inefficiencies, optimize resource allocation, and enhance service delivery. The telecom analytics market is projected to grow at a rate of 18% as operators seek to improve their bottom line through data-driven strategies. This focus on efficiency not only helps in cost reduction but also enables telecom companies to respond swiftly to market changes and customer demands. As a result, operational efficiency is becoming a key driver of growth in the telecom analytics market.

Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies is significantly influencing the telecom analytics market. As IoT devices proliferate across the GCC, telecom operators are compelled to adopt advanced analytics solutions to manage the influx of data generated by these devices. The telecom analytics market is expected to witness a growth rate of around 20% in the coming years, as operators utilize analytics to monitor device performance, optimize resource allocation, and enhance service offerings. This integration not only improves operational efficiency but also enables telecom companies to create new revenue streams through innovative IoT-based services. Consequently, the ability to analyze and interpret data from IoT devices is becoming a critical component of success in the telecom analytics market.

Rising Demand for Data-Driven Insights

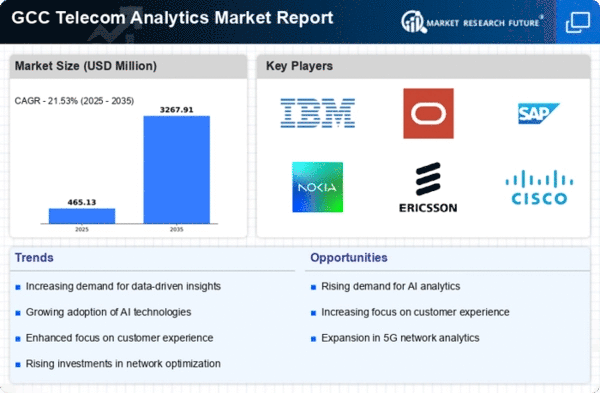

The telecom analytics market is experiencing a surge in demand for data-driven insights, particularly within the GCC region. As telecom operators seek to optimize their operations and enhance service delivery, the reliance on analytics tools has become paramount. In 2025, the market is projected to grow at a CAGR of approximately 15%, driven by the need for actionable intelligence derived from vast data sets. This trend is indicative of a broader shift towards data-centric decision-making, where telecom companies leverage analytics to improve network performance and customer satisfaction. The increasing complexity of telecom networks necessitates sophisticated analytics solutions, which are essential for identifying trends, predicting customer behavior, and ultimately driving revenue growth in the telecom analytics market.

Leave a Comment