Enhanced Regulatory Frameworks

The establishment of clear regulatory frameworks is becoming a pivotal driver for the web 3.0 blockchain market in the GCC. Governments are actively working to create policies that support blockchain innovation while ensuring consumer protection and financial stability. In 2025, several GCC countries have introduced regulations that facilitate the use of cryptocurrencies and blockchain technologies, which could potentially increase market participation. This regulatory clarity is likely to attract more businesses and investors, fostering a safer environment for blockchain operations. Consequently, the web 3-0-blockchain market may experience accelerated growth as stakeholders gain confidence in the legal landscape surrounding these technologies.

Increased Adoption of Smart Contracts

The adoption of smart contracts is emerging as a significant driver for the web 3.0 blockchain market in the GCC. These self-executing contracts are gaining traction across various sectors, including finance, real estate, and logistics. In 2025, it is projected that the use of smart contracts will increase by 50% among businesses in the region, as they seek to automate processes and reduce operational costs. This growing trend indicates a shift towards more efficient and transparent business practices. Consequently, the web 3-0-blockchain market is expected to benefit from this increased adoption, as smart contracts facilitate seamless transactions and enhance trust among parties.

Rising Investment in Blockchain Startups

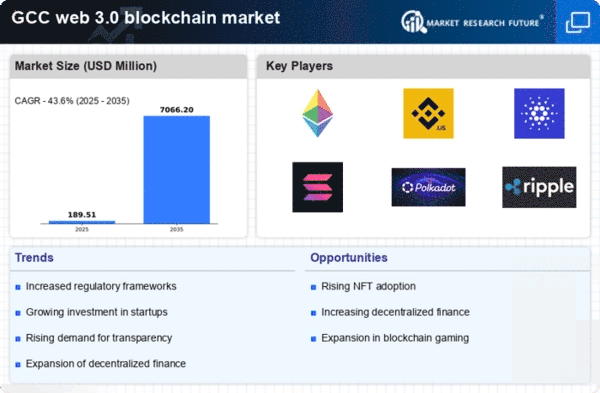

The web 3.0 blockchain market is witnessing a surge in investment from both private and public sectors within the GCC. In 2025, venture capital funding for blockchain startups in the region has increased by approximately 40%, indicating a robust interest in innovative solutions. This influx of capital is likely to accelerate the development of decentralized applications and services, enhancing the overall ecosystem. Furthermore, government-backed initiatives are encouraging local entrepreneurs to explore blockchain technology, fostering a competitive landscape. As a result, the web 3-0-blockchain market is expected to expand significantly, driven by the growing number of startups and their innovative approaches to solving real-world problems.

Growing Demand for Transparency and Security

In an era where data breaches and fraud are prevalent, the demand for transparency and security is driving the web 3.0 blockchain market in the GCC. Organizations are increasingly adopting blockchain solutions to enhance data integrity and traceability. In 2025, it is estimated that around 30% of enterprises in the region are implementing blockchain technology to secure transactions and improve supply chain transparency. This trend suggests that businesses recognize the potential of blockchain to mitigate risks associated with traditional systems. As a result, the web 3-0-blockchain market is likely to flourish as more companies seek to leverage these advantages to build trust with their customers.

Collaboration Between Tech Giants and Startups

Collaborations between established technology companies and startups are becoming a notable driver for the web 3.0 blockchain market in the GCC. In 2025, several partnerships have emerged, aiming to combine resources and expertise to develop innovative blockchain solutions. These collaborations are likely to accelerate the pace of technological advancements and broaden the application of blockchain across various industries. As larger firms leverage the agility of startups, the web 3-0-blockchain market may witness a surge in innovative products and services. This synergy could potentially lead to a more dynamic ecosystem, fostering growth and attracting further investment.